Analýza obchodov a tipy na obchodovanie s eurom

Vzhľadom na nízku volatilitu neboli úrovne, ktoré som určil v prvej polovici dňa otestované.

Vzhľadom na aktuálnu nepredvídateľnosť, ktorej čelia účastníci devízového trhu, a úplnú absenciu akejkoľvek reakcie na zverejnenie zápisnice zo zasadnutia Európskej centrálnej banky, je nedostatok aktivity zo strany obchodníkov celkom očakávaný. Správa zverejnená po poslednom zasadnutí ECB poukázala na zámer regulačného orgánu udržať úrokové sadzby nezmenené, keďže ukazovatele inflácie už nespôsobujú žiadne obavy. Za týchto okolností sa mnohí účastníci trhu rozhodli zaujať opatrný postoj a vyhýbať sa aktívnemu obchodovaniu.

Neskôr budú zverejnené ekonomické údaje z USA. Počet nových žiadostí o podporu v nezamestnanosti je dôležitým ukazovateľom podmienok na trhu práce. Nárast tohto čísla signalizuje možné spomalenie hospodárskeho rastu a pravdepodobný nárast nezamestnanosti, čo môže mať negatívny vplyv na spotrebiteľské výdavky a celkovú podnikateľskú činnosť. Problémom pre kupujúcich dolára by mohlo byť revidovanie HDP za tretí štvrťrok 2025 smerom nadol. Na druhej strane, zrýchlenie hospodárskeho rastu nad rámec prognóz účastníci trhu zvyčajne vnímajú pozitívne.

Nakoniec bude zverejnený celkový index výdavkov na osobnú spotrebu. Nárast tohto ukazovateľa by mohol slúžiť ako stimul pre tvrdšiu politiku Federálneho rezervného systému v oblasti úrokových sadzieb, čo by mohlo viesť k posilneniu amerického dolára.

Pokiaľ ide o intradenné obchodovanie, plánujem postupovať na základe scenárov č. 1 a č. 2.

Nákupný signál

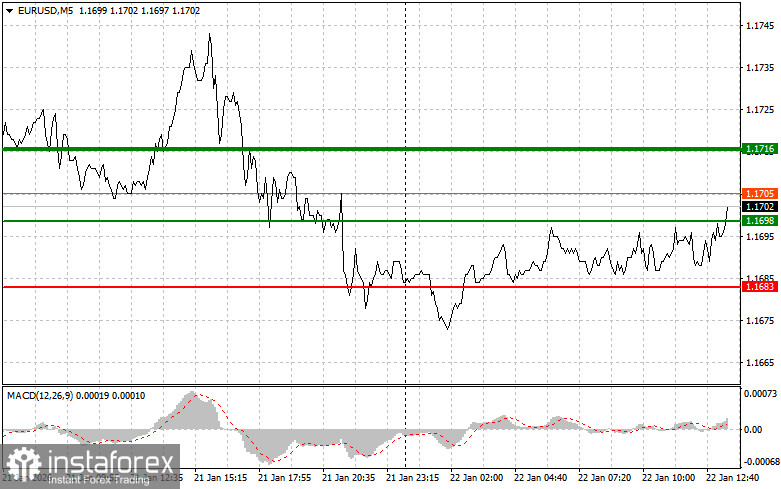

Scenár č. 1: dnes plánujem kúpiť euro, keď dosiahne oblasť úrovne 1,1709 (zelená čiara na grafe), pričom očakávam, že vzrastie na úroveň 1,1728. Na tejto úrovni zatvorím nákupné pozície a otvorím predajné pozície v opačnom smere, pričom počítam s pohybom vo veľkosti 30 ‒ 35 bodov od bodu vstupu na trh. Silný rast eura môžeme očakávať iba v prípade slabých ekonomických údajov. Dôležité! Pred nákupom sa uistite, že indikátor MACD je nad nulovou hodnotou a práve z nej začína rásť.

Scenár č. 2: nákup eura dnes plánujem aj v prípade, že cena dvakrát po sebe otestuje úroveň 1,1687, keď bude indikátor MACD v prepredanej oblasti. To obmedzí potenciál páru klesať a povedie k obratu trhu smerom nahor. Môžeme očakávať rast k úrovniam 1,1709 a 1,1728.

Predajný signál

Scenár č. 1: dnes plánujem predať euro, keď dosiahne úroveň 1,1687 (červená čiara na grafe). Cieľ bude na úrovni 1,1657, kde ukončím predaj, a okamžite otvorím nákupné pozície v opačnom smere (počítam s pohybom vo veľkosti 20 ‒ 25 pipov v opačnom smere od tejto úrovne). Tlak na pár sa obnoví po zverejnení silných ekonomických údajov. Dôležité! Pred predajom sa uistite, že indikátor MACD sa nachádza pod nulovou hodnotou a práve od nej začína klesať.

Scenár č. 2: dnes plánujem predať euro aj v prípade, že cena dvakrát po sebe otestuje úroveň 1,1709, keď bude indikátor MACD v prekúpenej oblasti. To obmedzí potenciál páru klesať a povedie k obratu trhu smerom nadol. Môžeme očakávať pokles k úrovniam 1,1687 a 1,1657.

Čo je na grafe

- Tenká zelená čiara ‒ vstupná cena, za ktorú môžete kúpiť obchodný nástroj.

- Hrubá zelená čiara ‒ odhadovaná cena, pri ktorej môžete nastaviť take profit alebo manuálne vybrať zisky, pretože ďalší rast nad túto úroveň je nepravdepodobný.

- Tenká červená čiara ‒ vstupná cena, pri ktorej môžete obchodný nástroj predať.

- Hrubá červená čiara ‒ odhadovaná cena, pri ktorej môžete nastaviť take profit alebo manuálne vybrať zisky, keďže ďalší pokles pod túto úroveň je nepravdepodobný.

- Indikátor MACD ‒ dôležitý pri identifikácii prekúpených a prepredaných zón s cieľom urobiť rozhodnutie o vstupe na trh.

Dôležité: začínajúci forexoví obchodníci by mali robiť rozhodnutia o vstupe na trh veľmi opatrne. Aby ste predišli prudkým cenovým výkyvom, je najlepšie nevstupovať na trh pred zverejnením dôležitých fundamentálnych správ. Ak sa rozhodnete obchodovať počas zverejňovania správ, vždy nastavte príkazy stop, aby ste minimalizovali straty. Bez príkazov stop môžete rýchlo prísť o celý svoj vklad, najmä ak nevyužívate money management a obchodujete veľké objemy.

Nezabúdajte, že na úspešné obchodovanie potrebujete jasný obchodný plán, ako je napríklad ten, ktorý je uvedený vyššie. Prijímanie spontánnych obchodných rozhodnutí na základe aktuálnej situácie na trhu je pre intradenného obchodníka vo svojej podstate stratová stratégia.

Slovenský

Slovenský

Русский

Русский English

English Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română