Bitcoin takmer dosiahol 89 000 dolárov a ethereum sa priblížilo k hranici 3 000 dolárov. V súčasnosti na trhu s kryptomenami neexistuje výrazný optimizmus.

Včera sa objavila správa, že pojednávanie o pozmeňujúcich a doplňujúcich návrhoch a hlasovanie o rozsiahlom zákone o kryptomenách, CLARITY, bolo opäť odložené kvôli snehovej búrke vo Washingtone. Senátny výbor pre poľnohospodárstvo mal pôvodne zasadnúť v utorok, ale výbor teraz presunul zasadnutie na štvrtok.

Plánované pojednávania budú prvým prípadom, keď Senát začne diskutovať o pozmeňujúcich a doplňujúcich návrhoch a hlasovaní o legislatíve týkajúcej sa kryptomien, a to po neúspechoch v paralelnom procese v senátnom bankovom výbore, ktorý musel svoje pojednávania odložiť. Výbor pre poľnohospodárstvo má právomoc nad Komisiou pre obchodovanie s komoditnými futures (CFTC), zatiaľ čo bankový výbor dohliada na Komisiu pre cenné papiere a burzy (SEC) – dve agentúry, ktoré zohrávajú ústrednú úlohu v regulácii kryptomien.

Minulý týždeň senátny výbor pre poľnohospodárstvo pod vedením republikánov zverejnil text svojho návrhu zákona, ktorý však nezískal podporu demokratov. Jasnosť zostáva hlavným faktorom, ktorý by mohol vrátiť optimizmus na trh, preto v blízkej budúcnosti neočakávame silné oživenie trhu s kryptomenami.

Čo sa týka intradennej stratégie obchodovanie na kryptotrhu, aj naďalej sa budem zameriavať na výrazné pullbacky bitcoinu a etherea, pretože očakávam, že aktuálny rastúci trend bude v strednodobom horizonte pokračovať.

Stratégia a podmienky ku krátkodobému obchodovaniu sú uvedené nižšie.

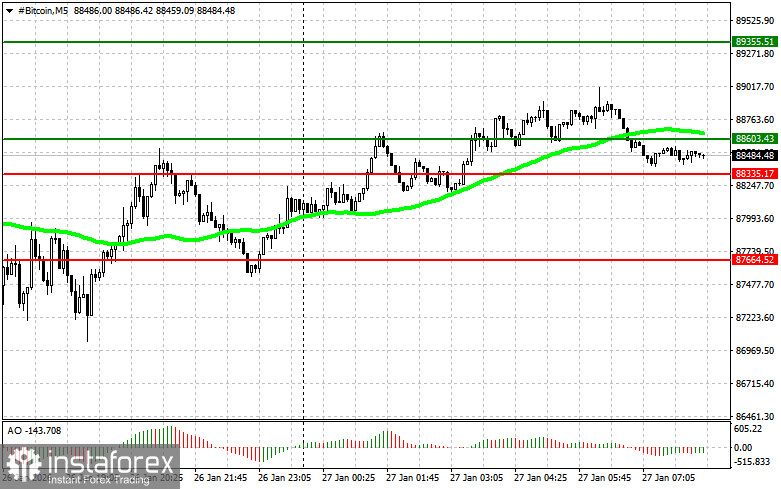

Bitcoin

Nákupný scenár

Scenár č. 1: dnes kúpim bitcoin, keď dosiahne bod vstupu na trh v oblasti úrovne 88 600 USD, pričom očakávam, že vzrastie na úroveň 89 300 USD. V oblasti tejto úrovne ukončím nákupy a pri odraze otvorím predajné pozície. Pred nákupom pri prerazení sa uistite, že 50-dňový kĺzavý priemer je pod aktuálnou cenou a oscilátor Awesome je v oblasti kladných hodnôt.

Scenár č. 2: ak trh nezareaguje na prerazenie, bitcoin môžete kúpiť aj po dosiahnutí spodnej hranice na úrovni 88 300 USD, pričom ciele sú na úrovni 88 600 USD a 89 300 USD.

Predajný scenár

Scenár č. 1: dnes predám bitcoin, keď dosiahne bod vstupu na trh v oblasti úrovne 88 300 USD, pričom očakávam, že klesne na úroveň 87 600 USD. V oblasti tejto úrovne ukončím predaje a pri odraze otvorím nákupné pozície. Pred predajom pri prerazení sa uistite, že 50-dňový kĺzavý priemer je nad aktuálnou cenou a oscilátor Awesome je v oblasti záporných hodnôt.

Scenár č. 2: ak trh nezareaguje na prerazenie, bitcoin môžete predať aj po dosiahnutí hornej hranice na úrovni 88 600 USD, pričom ciele sú na úrovni 88 300 USD a 87 600 USD.

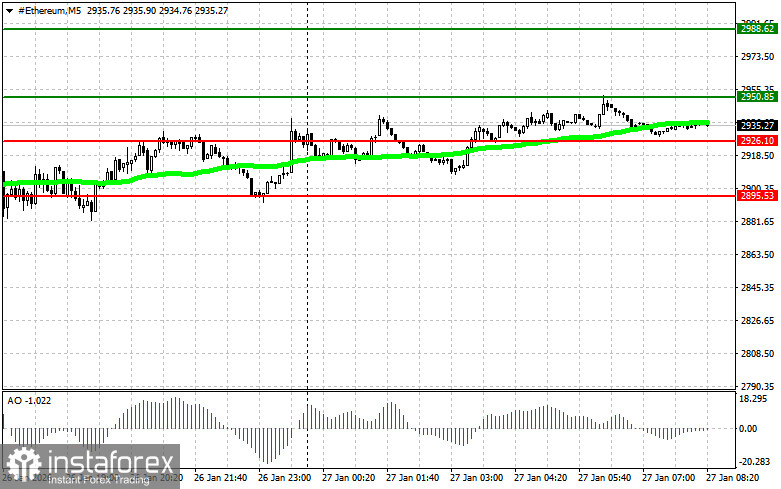

Ethereum

Nákupný scenár

Scenár č. 1: dnes plánujem kúpiť ethereum, keď dosiahne bod vstupu na trh v oblasti úrovne 2 950 USD, pričom očakávam, že vzrastie na úroveň 2 988 USD. Na tejto úrovni ukončím nákupy a pri odraze otvorím predajné pozície. Pred nákupom pri prerazení sa uistite, že 50-dňový kĺzavý priemer je pod aktuálnou cenou a oscilátor Awesome je v oblasti kladných hodnôt.

Scenár č. 2: ak trh nezareaguje na prerazenie, ethereum môžete kúpiť aj po dosiahnutí spodnej hranice na úrovni 2 926 USD. Ciele sú na úrovni 2 950 USD a 2 988 USD.

Predajný scenár

Scenár č. 1: dnes môžete predať ethereum, keď dosiahne bod vstupu na trh v oblasti úrovne 2 926 USD, pričom očakávam, že klesne na úroveň 2 895 USD. Na tejto úrovni ukončím predaje a pri odraze okamžite otvorím nákupné pozície. Pred predajom pri prerazení sa uistite, že 50-dňový kĺzavý priemer je nad súčasnou cenou a oscilátor Awesome je v oblasti záporných hodnôt.

Scenár č. 2: ethereum môžete predať aj po dosiahnutí hornej hranice na úrovni 2 950 USD za predpokladu, že nedôjde k prerazeniu. Ciele sú na úrovni 2 926 USD a 2 895 USD.

Slovenský

Slovenský

Русский

Русский English

English Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română