Tax evasion is considered one of the heaviest wrongdoings in any country. There have been plenty of cases in contemporary history when well-known and influential people had to incur severe penalties for their schemes to pinch big money from a treasury.

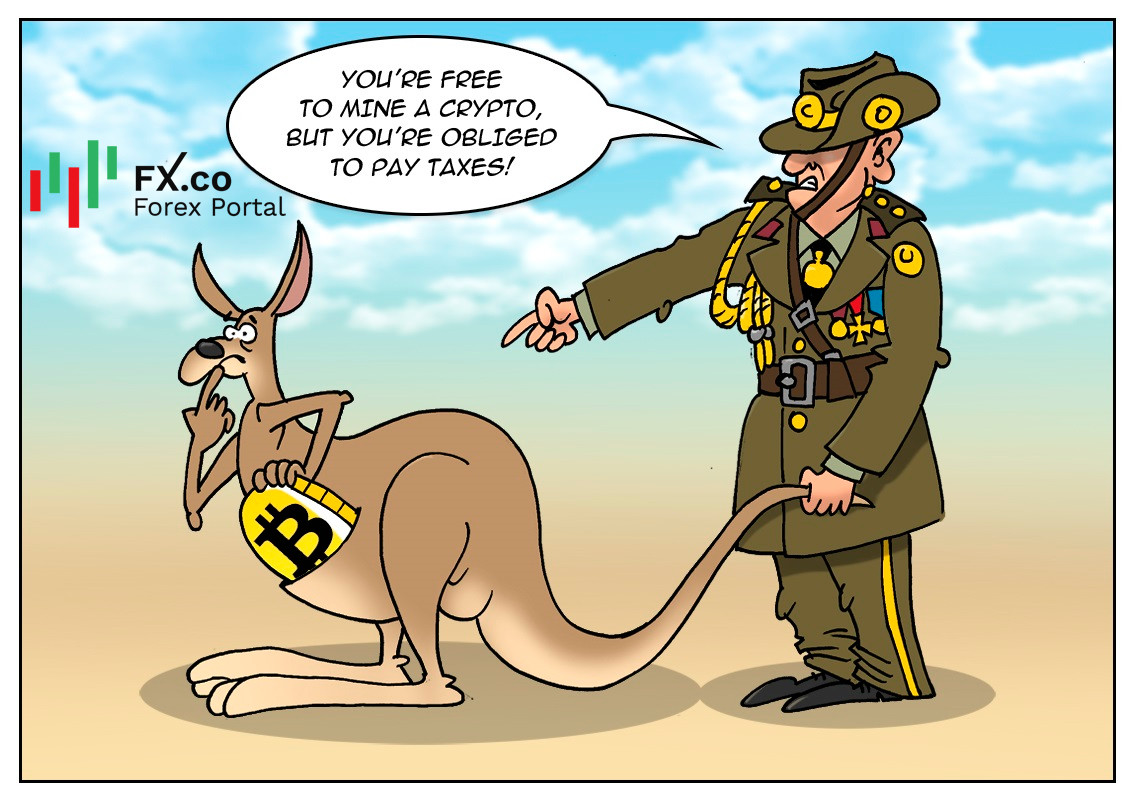

Interestingly, as soon as cryptocurrencies were introduced into the financial world, people welcomed the new financial instrument, thinking that it would allow them to avoid both taxes and any punishment. However, they have to confront the bitter reality. Authorities in many countries around the world came up promptly with the appropriate legislation and even decided to crack down on the crypto industry. The Australian Taxation Office has been tracking crypto traders since late 2019. Recently, 100,000 Australian residents received a notice that they have to update their income declarations on cryptocurrency transactions for 2020. Deputy commissioner Tim Loh made a statement on behalf of the Taxation Office. “We are alarmed that some taxpayers think that the anonymity of cryptocurrencies provides a licence to ignore their tax obligations,” Mr. Loh said. So, the tax authorities urge investors to report income generated from digital currency transactions.

According to the Australian federal law, all digital assets, including NFTs, are considered a form of property. So, they are taxed as capital gains. Currently, every 5th Australian citizen holds crypto assets. No wonder, the government is unwilling to lose this lucrative source of budget revenues. In May 2021, Senator Andrew Bragg called on the authorities to tighten regulation of the crypto market in Australia.

বাংলা

বাংলা

Русский

Русский English

English Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română

Comments: