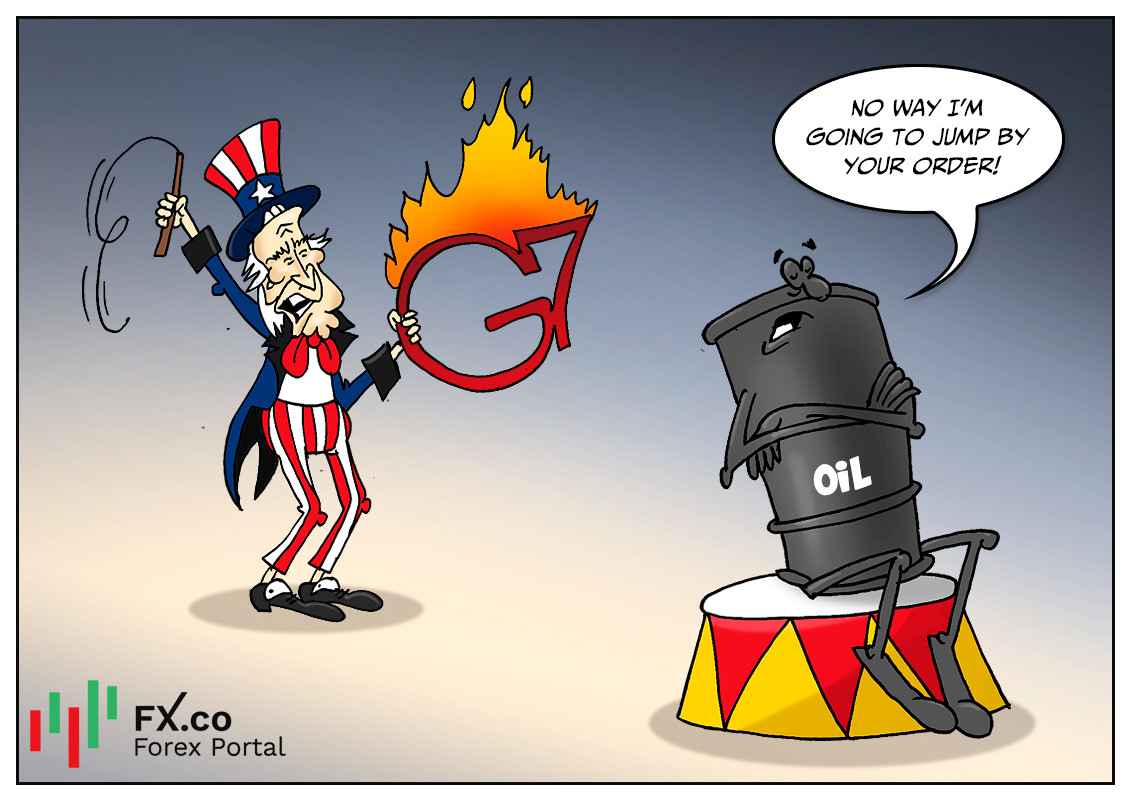

Not everyone is optimistic about a proposed price cap on Russian oil. Representatives of energy companies not only oppose such a decision but also do not understand how this mechanism will be put into practice.

The idea of imposing a ceiling on the price paid for Russian oil may backfire. The Group of Seven nations' efforts to further reduce Moscow's revenues could violate the rules of free competition. Moreover, such a plan seems to be ill-conceived in the face of a growing shortage of petroleum products. Thus, Shell Chief Executive Officer Ben van Beurden has raised doubts about a decision by G7 leaders, deeming it ineffective. He believes that the world is heading for a “turbulent period” as tightening supplies of LNG and oil deepen a global energy crunch. “You can see all the flaws already,” Beurden added, answering the question about a possible price cap on Russian oil. According to him, this scheme will take effect only if countries beyond Europe and the United States join it.

Otherwise, “you will continue to just see what is currently happening, which is Russian crude will go to countries that are perfectly OK to still purchase Urals, for instance,” he explained.

Meanwhile, leaders of the Group of Seven rich democracies are considering ways of setting a price ceiling for Russian oil and are having "very constructive" discussions on this topic, a German government official said.

বাংলা

বাংলা

Русский

Русский English

English Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română

Comments: