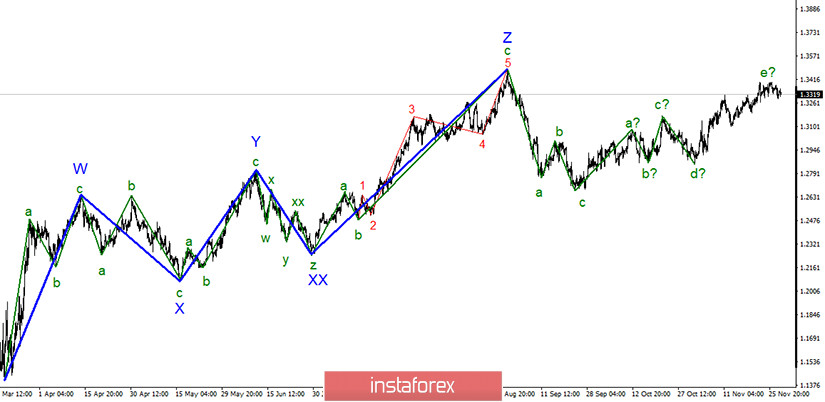

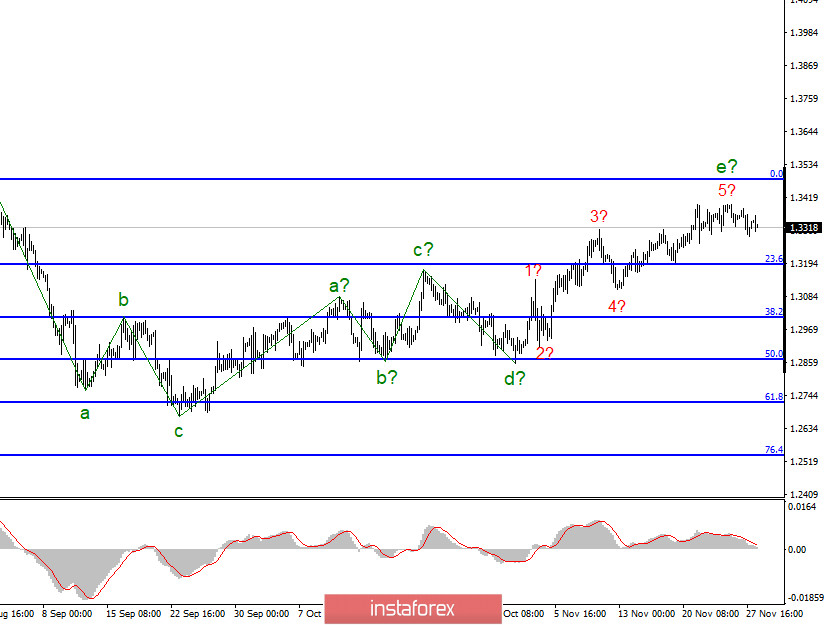

In the most global terms, the construction of the upward trend section continues, however, the wave marking takes a complex form and may become more complicated more than once. The section of the trend that started on September 23 took a five-wave form, but not an impulse one. A successful attempt to break the previous peak indicates that the markets are ready for further purchases of the British pound. The proposed wave e has also taken a five-wave form and may already be completed.

The lower chart clearly shows the a-b-c-d-e waves of the upward trend section. The assumed wave e took a five-wave form, which is also visible on the chart. However, even with this complication, it is nearing completion. At the same time, the demand for the British remains quite high. This means that the upward section of the trend can be complicated almost an infinite number of times. However, I am still inclined to the option with the beginning of a fall in the instrument's quotes in the near future.

Articles in the British say the same thing every day. Negotiations between Michel Barnier and David Frost have resumed and will continue for at least another week. London and Brussels still do not make any statements about the progress in the negotiations. All comments relate only to the attitude of a high-ranking official. Both sides continue to insist that they will not seek a deal at any cost. Once again, there were statements that if an agreement is not reached by the end of this week, then we should prepare for a hard Brexit. However, the markets have heard this a dozen times. Still, the negotiations continue, because we are talking about a really big deal, almost 1 trillion euros. Of course, neither the EU nor the UK wants to end Brexit without an agreement. But they also don't want to admit that they need a deal. Therefore, the general opinion is that everyone wants a deal, but everyone pretends that they are ready to do without it.

Meanwhile, the head of the British Treasury, Rishi Sunak, said that by the end of 2020, the British economy will lose about 11.3%, which will be the largest drop in 300 years. Sunak predicted a 5.5% recovery for the next year and a 6.6% growth in 2022. I wonder if the Treasury takes into account the option of no trade agreement, or whether these calculations are subject to the availability of a deal? Rishi Sunak also said that the economy will not return to pre-crisis levels until the end of 2022.

General conclusions and recommendations:

The pound/dollar instrument continues to build an upward trend, however, its last wave is nearing completion. Thus, now I recommend looking closely at the sales of the instrument, however, the British still do not give clear signals about the end of the upward section of the trend. At the same time, purchases of the instrument are now quite dangerous, given the uncertainty associated with the trade deal.

Español

Español

Русский

Русский English

English Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română