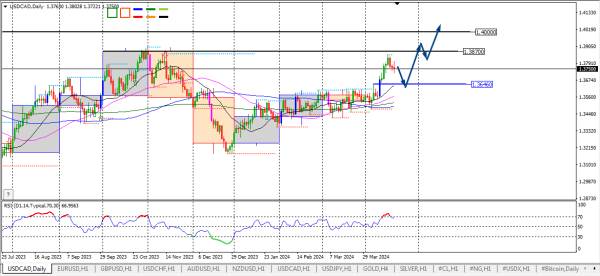

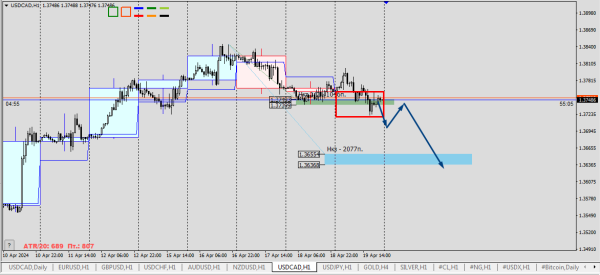

Hello colleagues, The USD/CAD pair is trading at 1.3755 after a decline on Friday. The pair was affected by strong market volatility due to the escalation of geopolitical tensions in the Middle East. The risk aversion spike following reports of Israel's retaliatory attacks on Iran supported the US dollar, as well as other safe-haven assets like gold, JPY, and CHF. However, the impact on USD/CAD was muted due to the conflict's influence on oil prices and the Canadian dollar's sensitivity to oil prices. WTI crude oil prices rose by more than 4.0% from 81.80 to 85.50 after news of a presumed Israeli attack on Iran. This strengthened the CAD as oil is a major export commodity for the country. The USD/CAD pair remains in a short-term and medium-term uptrend despite the negative impact from oil prices. This is due to diverging views on the future trajectory of interest rates in the US and Canada. Interest rates are a key factor in the currency exchange rate as global capital tends to flow where interest rates are higher, all else being equal. On the daily chart, the trend remains upward with the next buying targets at 1.3870 and then 1.400. A correction may occur towards the level of 1.3646 before another upward move. The Canadian dollar has been trading higher for the third consecutive session on Friday and is on track for a moderate weekly recovery after sharp sell-offs in the previous two weeks. A weaker US dollar in the absence of key macroeconomic data and easing concerns about the Middle East conflict are contributing to the recovery of the Canadian dollar. Additionally, Iranian authorities downplay rumors of drone attacks from Israel. With no further escalation threat, immediate risk aversion is gradually diminishing, which is positive for the CAD. The price is trading within the 1/2 zone of 1.37493-1.37399, and a daily candle closing below this zone would indicate further downside towards the weekly control zone of 1.36554-1.36368. Next week, we will consider the possibility of selling the Canadian dollar.

*El análisis de mercado publicado aquí está destinado a aumentar su conocimiento, pero no a dar instrucciones sobre cómo realizar una operación