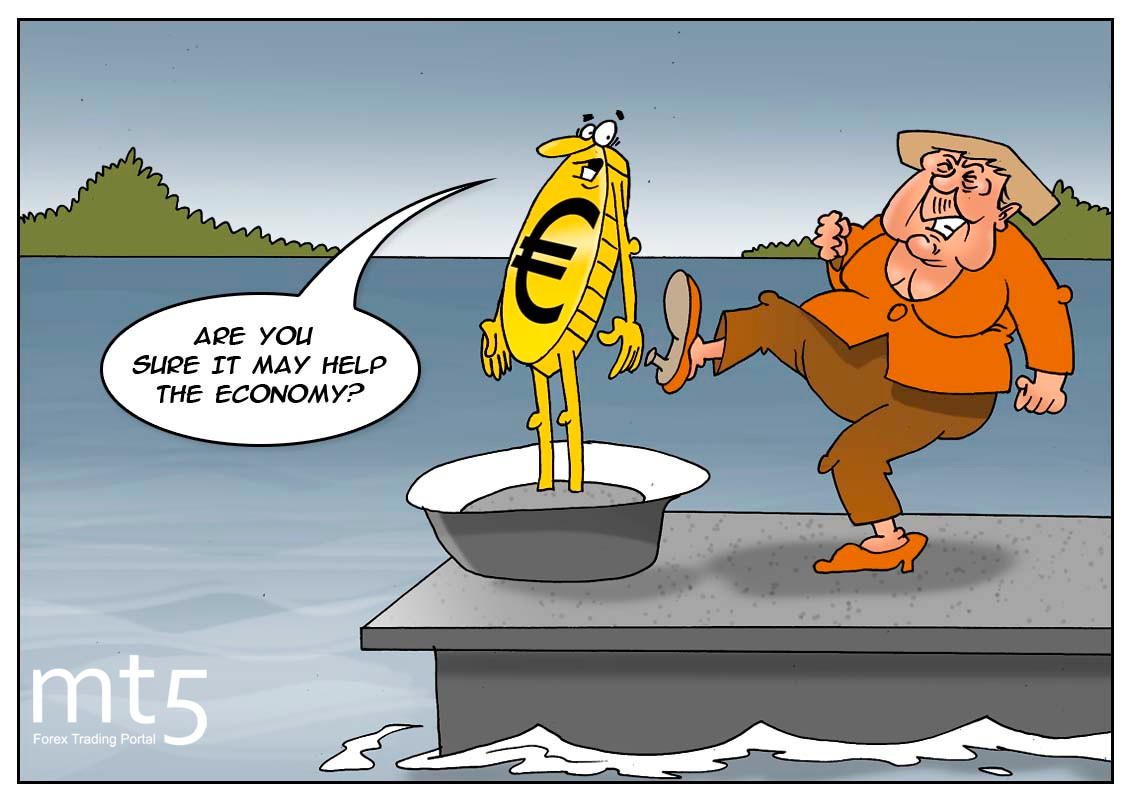

For some time, economists have been closely watching the steady rise of the euro. Therefore, they are more than sure that the ECB will take some steps to weaken it as the strong euro is bad for the economy. The European Central Bank is extremely concerned about its growth and ready to take action to prevent its further strengthening.

Over the past few weeks, the euro has been extending gains, which poses a great threat to the economy severely hit by the coronavirus pandemic. For this reason, the ECB is going to take measures, namely to revise its monetary policy. "In the current environment of lower inflation, the concerns we face are different (than in 2003) and this needs to be reflected in our inflation aim", ECB President Christine Lagarde said. On the one hand, her words once again justify changes in the current monetary policy. On the other hand, some market players do not share her opinion. They argue that low inflation is largely due to slow GDP growth, which weighs on the economy especially in the context of the global crisis. The crisis may end quite soon, and the ECB will be forced to change the interest rates again.

Notably, the current level of the rate directly affects not only interest on loans and deposits but also on bond yields and foreign investors’ demand. The euro exchange rate is hugely reliant on the demand from foreign investors. If the ECB key rate is low, then the euro-denominated assets will be less attractive for traders. As a result, the single currency itself will drop considerably.

Deutsch

Deutsch

Русский

Русский English

English Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română