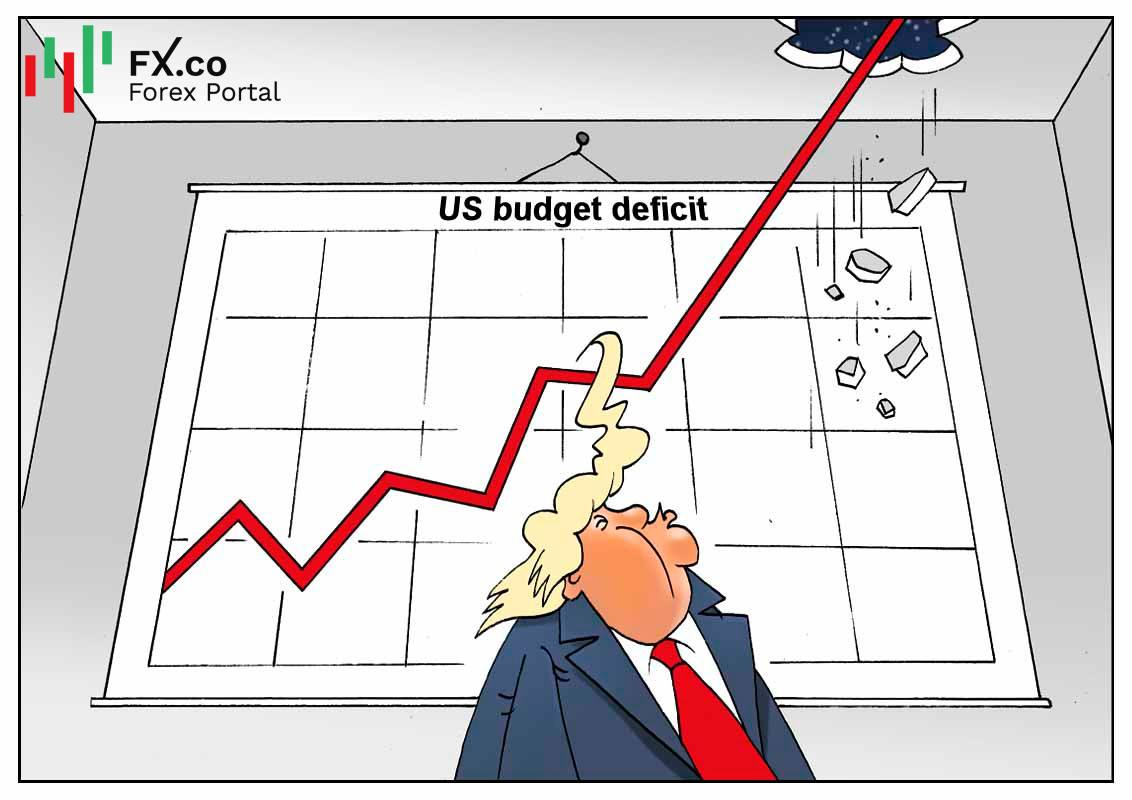

It goes without saying that an enormous budget deficit in the US poses a threat to the fiscal health of the top global economy. Oddly enough, a federal budget deficit was snowballing even in times of economic growth. However, amid the COVID-19 pandemic, experts point out an ominous trend.

The US Treasury Department reported that a budget deficit swelled twice to $284.071 billion as of the end of October from a year ago. This happened for obvious reasons: staggering public spending and low budget revenues. As a result, the federal government is now running a huge deficit not seen since World War II.

Experts pinpoint the pandemic-driven crisis as the catalyst for elevated government spending. Amid emergency support measures, public spending increased by 37.3% to $521.769 billion. At the same time, revenues dropped by 3.2% to $237.698 billion excluding tax revenues.

The US current account deficit ballooned nearly three times to $3.132 trillion in 2020 compared to 2019. Besides, the federal deficit surged to 15.2% of GDP, the highest level since 1945. Interestingly, even in times of the financial crisis in 2009, the current account deficit was measured at $1.413 trillion that was 9.8% of the national economic output. The last time when the US federal budget logged a proficit was in 2001.

Deutsch

Deutsch

Русский

Русский English

English Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română