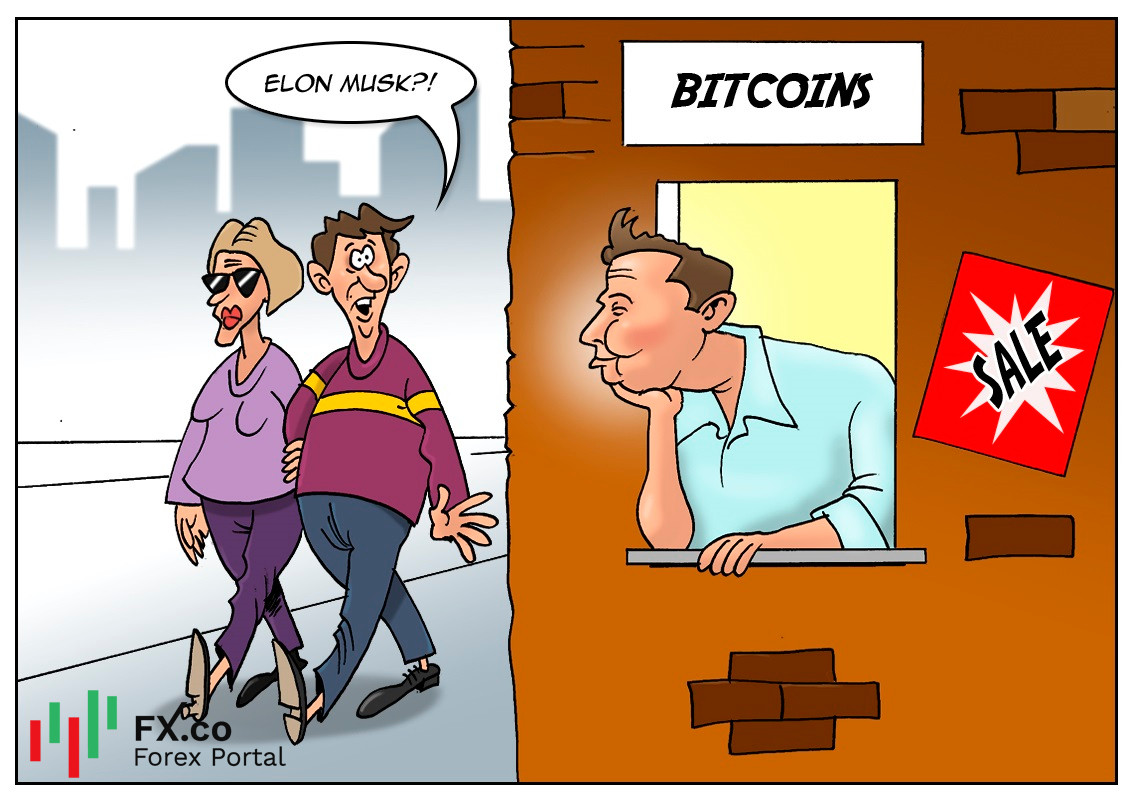

Elon Musk has decided to show how reliable bitcoin can be as a form of payment. He sold 10% of Tesla’s bitcoin holdings. At the same, Musk chose to retain his personal investment in the cryptocurrency. According to the company’s report, selling of 10% of BTC purchased in early 2021 brought Tesla $101 million in income. Back then, Musk invested over $1 billion in the flagship cryptocurrency. The billionaire explained that by selling 10% of Tesla’s BTC holdings he tried "to prove liquidity of bitcoin as an alternative to holding cash on the balance sheet."

Earlier this year, the company announced that it had started to accept payments in BTC to purchase its electric vehicles. This payment option was available in the United States. PayPal followed suit and allowed its customers in the US to pay at millions of online merchants globally with virtual cash. However, on Wednesday Musk announced that Tesla had suspended accepting Bitcoin: “Cryptocurrency is a good idea on many levels and we believe it has a promising future, but this cannot come at a great cost to the environment.” This statement led to a crash in Bitcoin prices.

Deutsch

Deutsch

Русский

Русский English

English Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română

Comments: