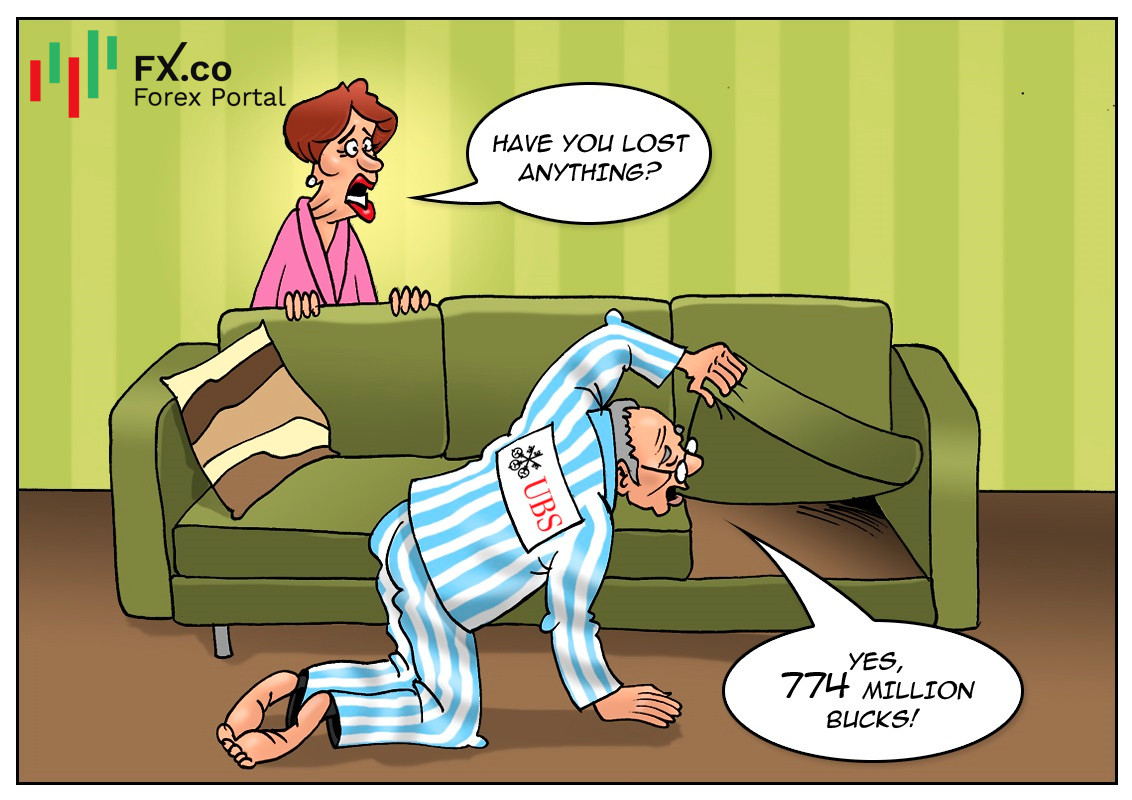

Swiss bank UBS has lost a huge sum of money and Archegos Capital is to blame. The Swiss bank giant took a $774 million hit from the collapse of Archegos Capital, following the failure of the fund to meet its margin calls.

All this had an adverse effect on the bank’s total performance. In the first quarter of the year, UBS’s net profit plunged by $434 million and investment banking pre-tax profit fell by 42%.

On its official website, the bank reported a $774 million loss related to a default by a US-based client of its prime brokerage business.

Archegos Capital’s problems started in March, giving a blow not only to Swiss bankers. Among the fund's clients were such large banks as Morgan Stanley, Deutsche Bank, Wells Fargo, Nomura, and Goldman Sachs. As a result, a $30 billion selling spree was arranged by the giants. They had to do so since Archegos Capital accumulating large positions in various companies had announced a default on margin commitments. The fund had large stakes in Baidu, Discovery, Tencent, and GSX Techedu.

Deutsch

Deutsch

Русский

Русский English

English Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română

Comments: