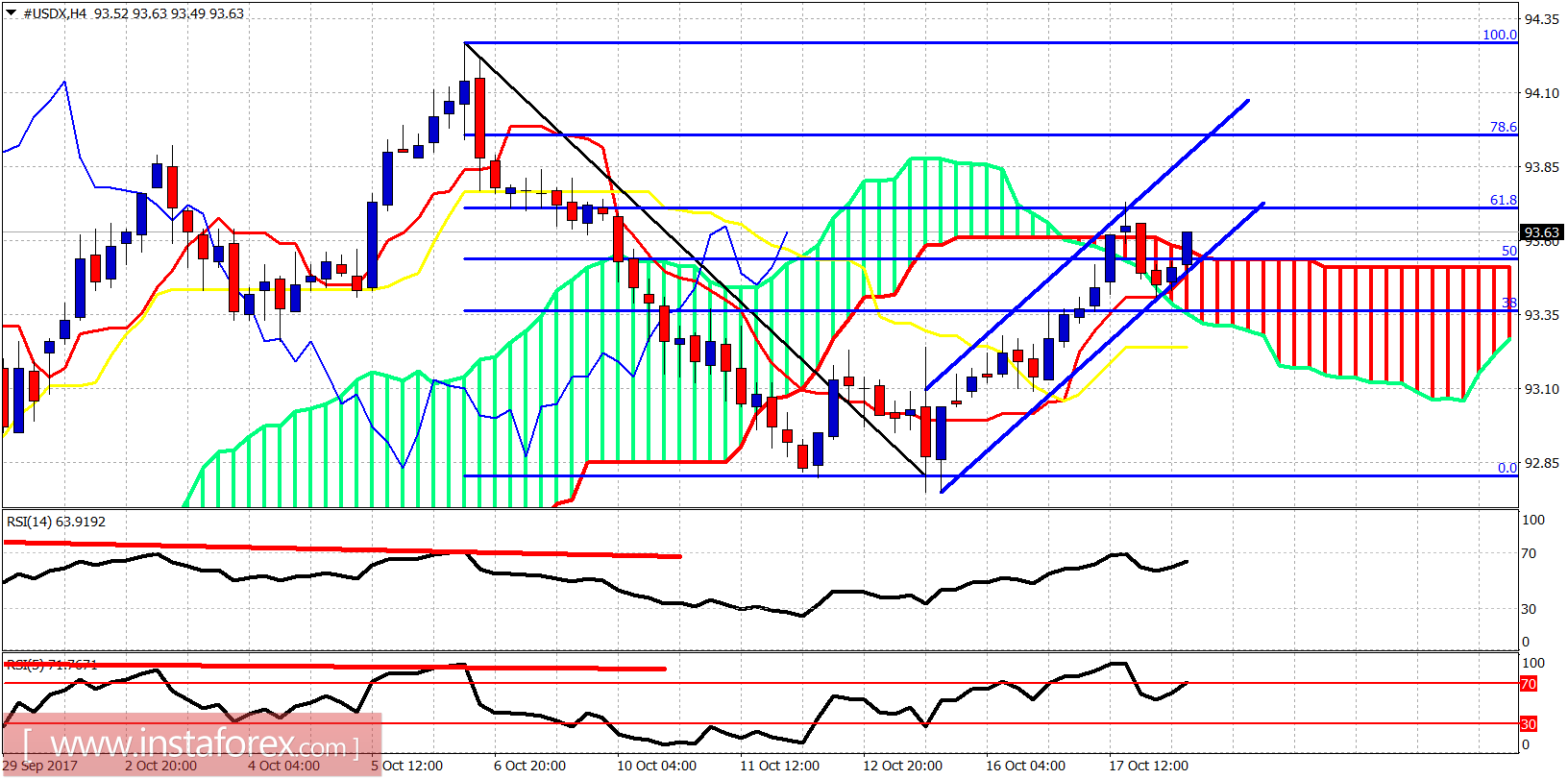

The Dollar index is in a bullish short-term channel breaking above the 4-hour cloud resistance. Price is approaching the 61.8% Fibonacci retracement of the recent decline. A rejection around this area will be a bearish sign and what I expect. The upward bounce is considered corrective.

Blue lines - bullish channel

The Dollar index is breaking above the 4-hour cloud. Price is inside the short-term bullish channel but there are a lot of chances even if price makes a new higher high above 93.73. In this case, it would produce a bearish divergence in the RSI and would complete the final correction before down trend resumes.

Blue lines - bullish channel

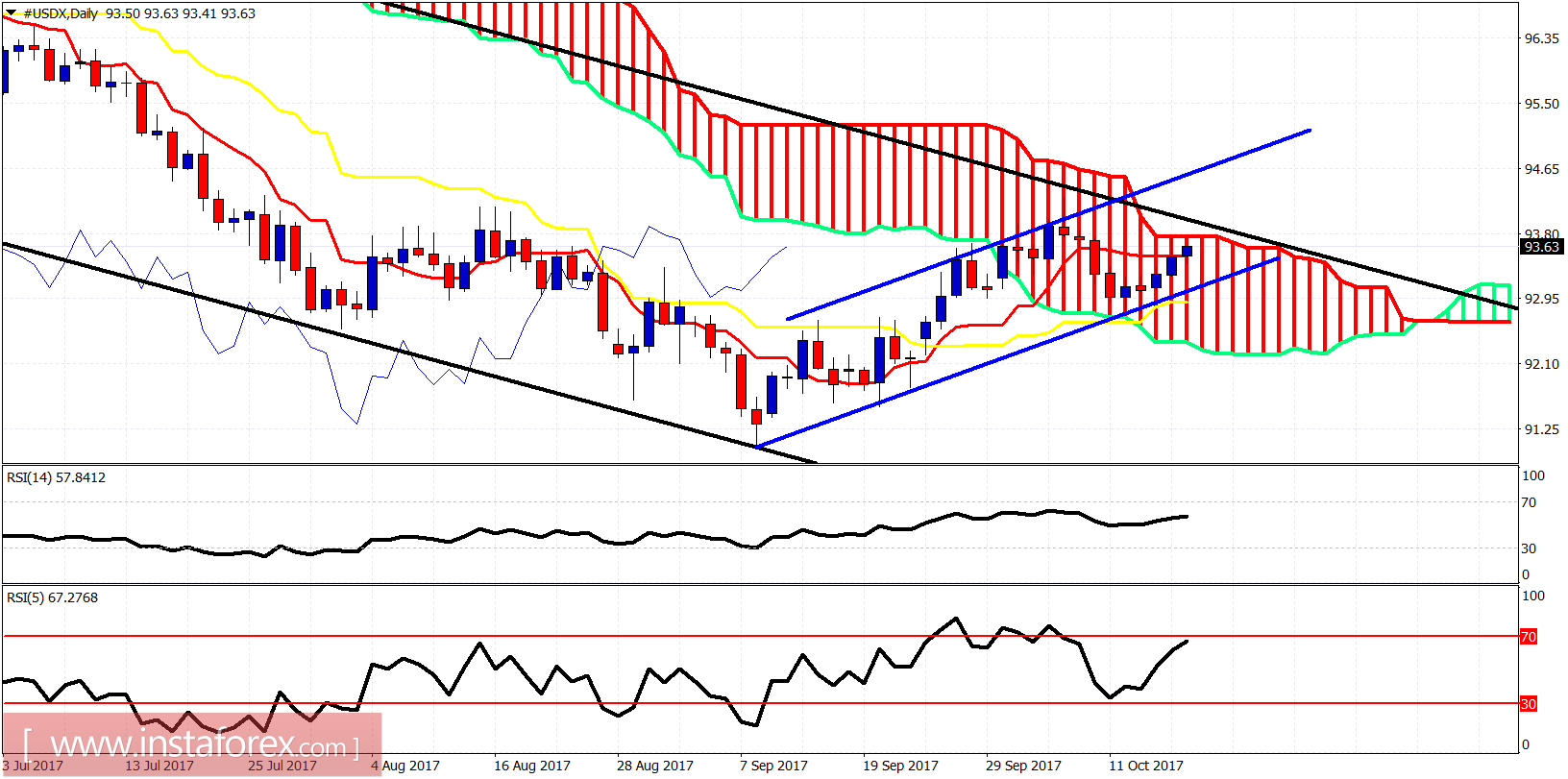

On a daily basis, we are currently inside the Kumo (cloud) implying trend is neutral. Price is trying to break above the black longer-term bearish channel while trading inside the short-term bullish channel. Support is at 93 while resistance is at 94. Breaking above 94 will increase the chances of a bigger bounce in play for the index.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română