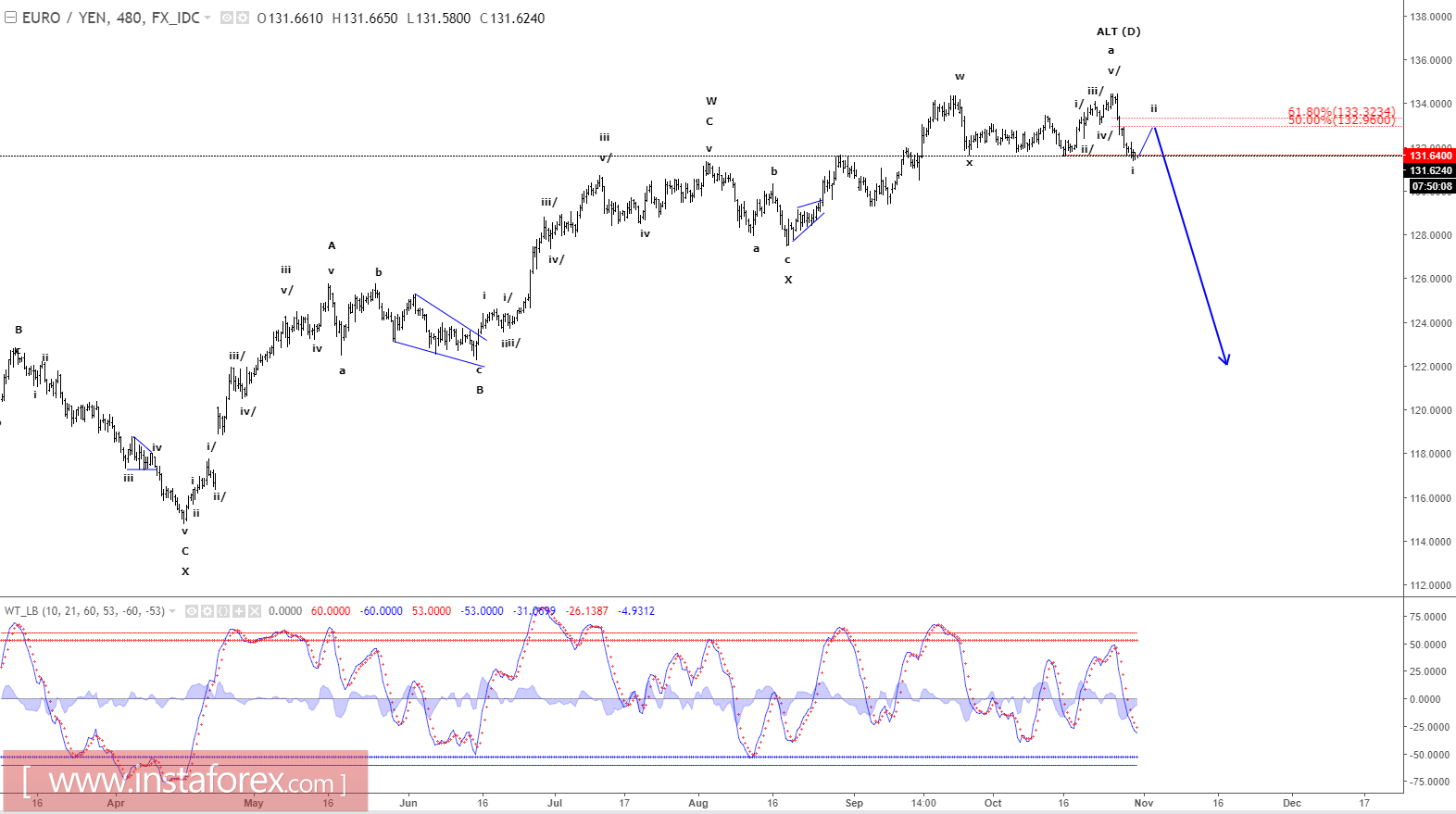

EYR/JPY - Weekly

EUR/JPY - 8 Hourly

Wave summary:

We are looking for the completion of wave (D) of a huge triangle consolidation, that began way back in July 2008. The ideal target for this (D) wave is seen at 137.37. However, the break below 131.60 is questioning whether this (D) wave could have completed already with the test of 134.49 and wave (E) already is developing. If the (E) wave is developing, then we should expect resistance in the 132.96 - 133.32 area to protect the upside for a strong break below support at 131.60 confirming a decline to 123.43.

R3: 132.96

R2: 132.32

R1: 131.95

Pivot: 131.60

S1: 131.09

S2: 130.60

S3: 129.96

Trading recommendation:

Our stop + revers at 131.60 has been hit with a loss of 70 pips. We are now short EUR from 131.60 and will place our stop at 132.00.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română