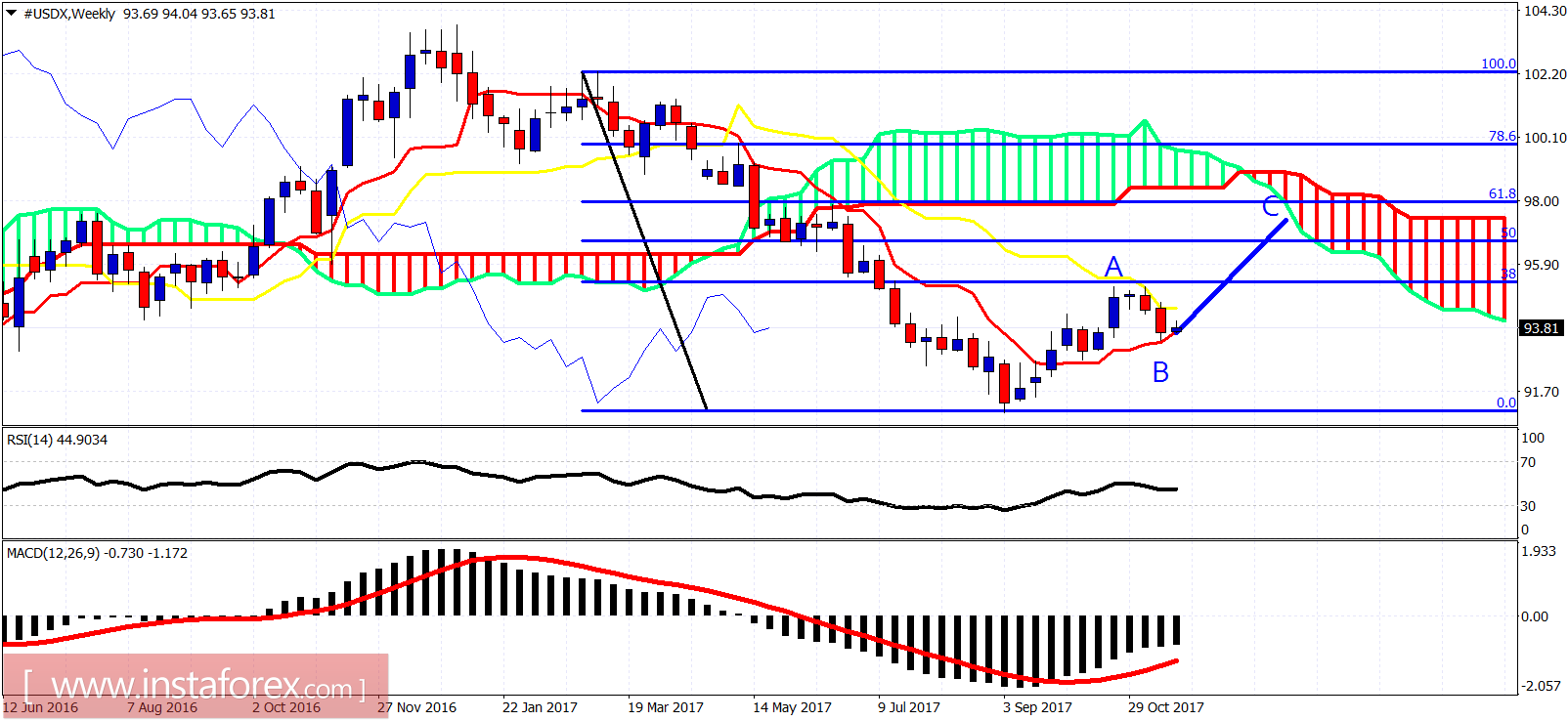

The Dollar index has stopped at the 38% Fibonacci retracement support as we noted in our latest analysis. This is a good support are where we could at least see a trade-able bounce. The Dollar index could still make a new lower low towards 93 before the bounce, but overall we should not ignore the bullish alternative wave counts.

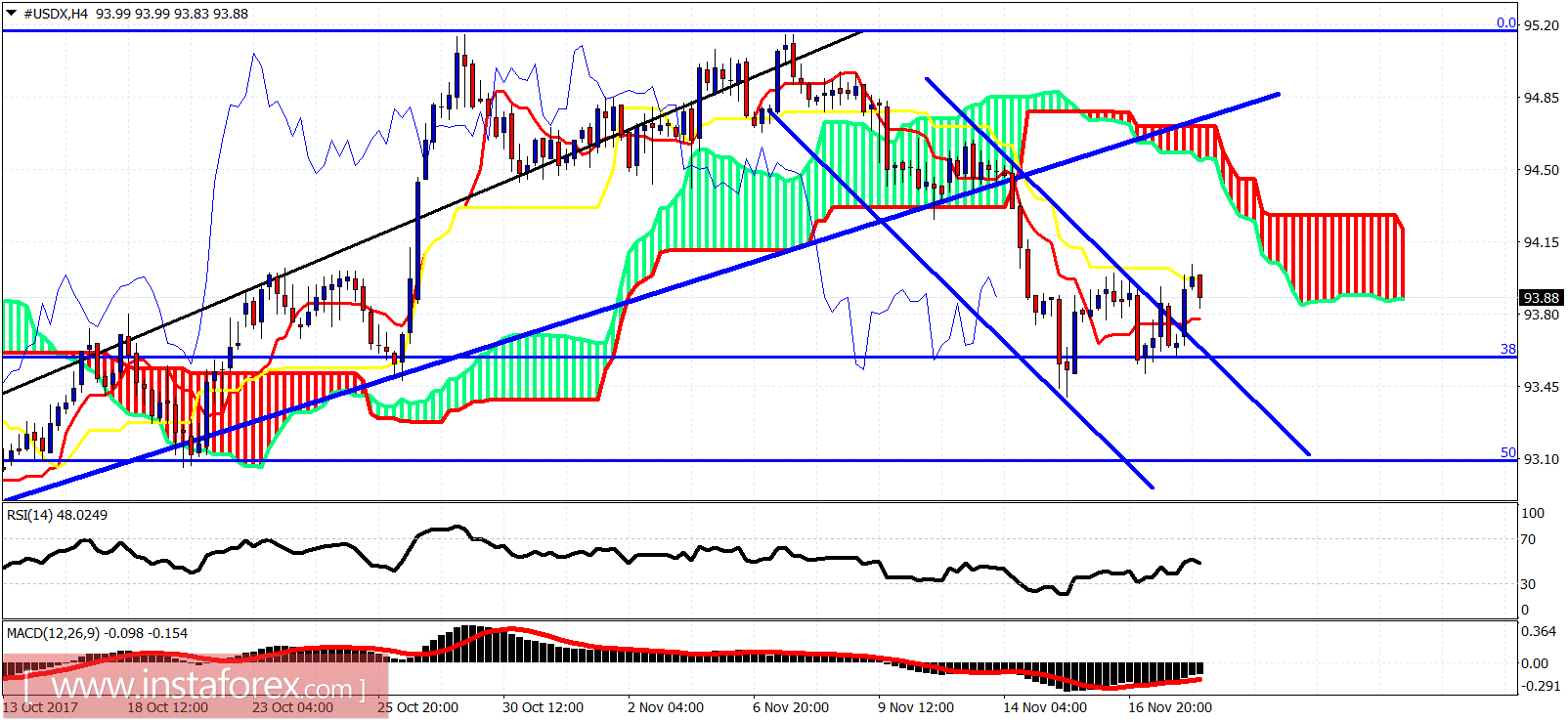

The Dollar index has broken out of the bearish channel. Is is a first bullish sign for a possible bounce. Price is below the Ichimoku cloud. Resistance is at 94.50. The decline so far is corrective in three waves, as the rise from September lows can be seen as impulsive. This implies that another leg higher is expected to follow.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română