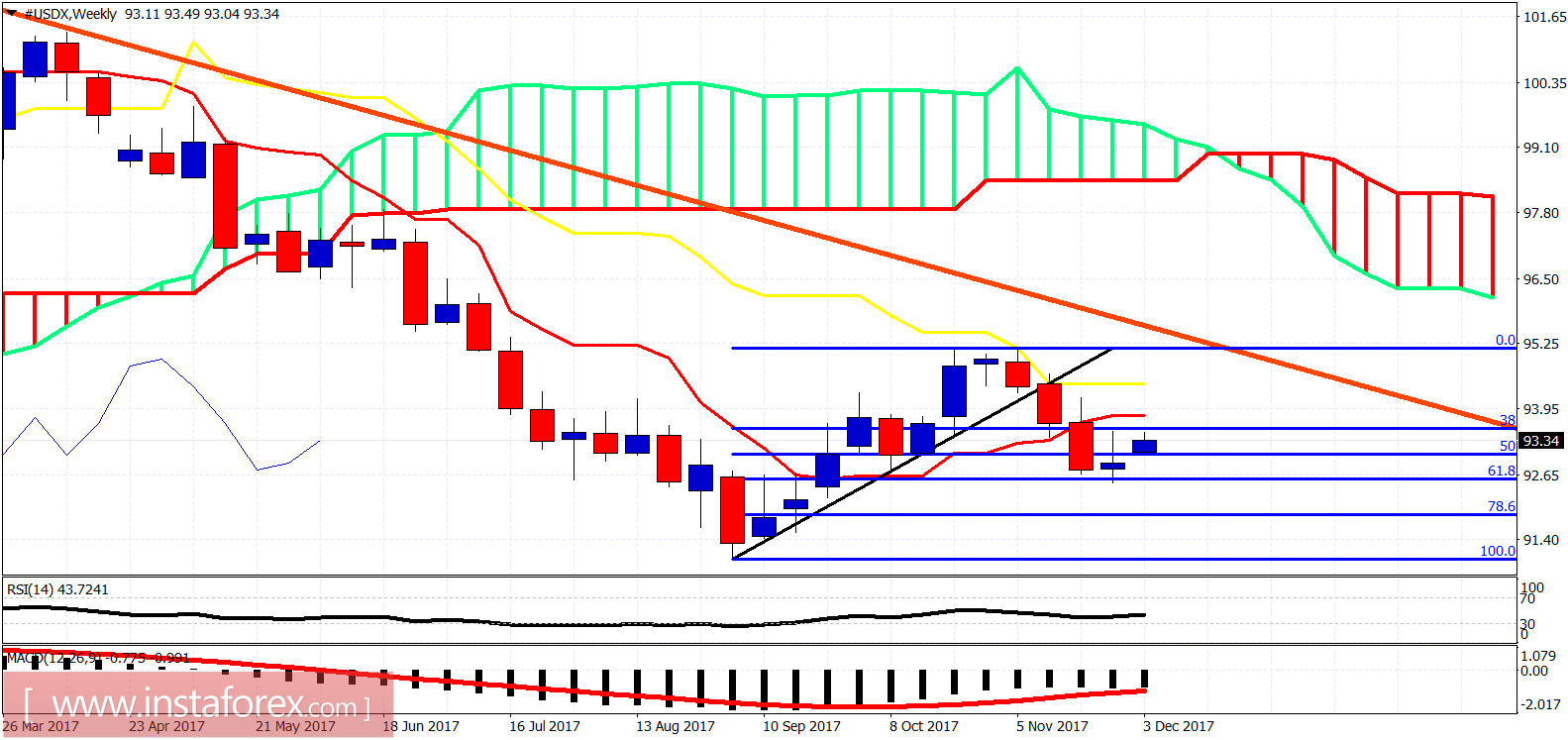

The Dollar index is moving higher as expected. Price briefly broke above cloud resistance yesterday but moved back inside the cloud. Today I expect the Dollar index to confirm the short-term bullish trend by breaking above 93.50.

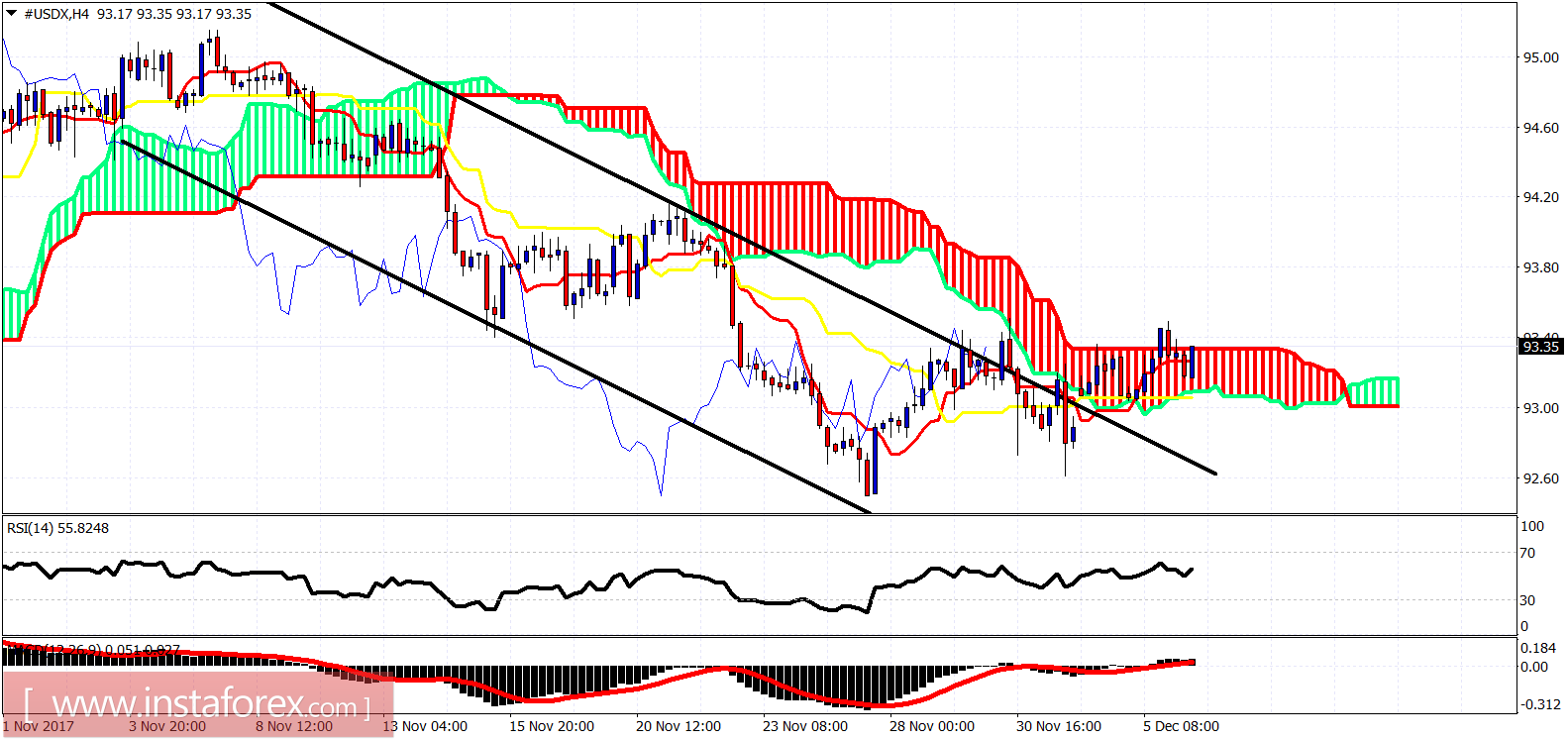

The Dollar index is inside the 4-hour Kumo (cloud). Trend is neutral but price is about to break above the cloud and change to bullish. Price has made an important reversal from our 92.50 target area. We are Dollar bullish looking for a test of November- October highs.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română