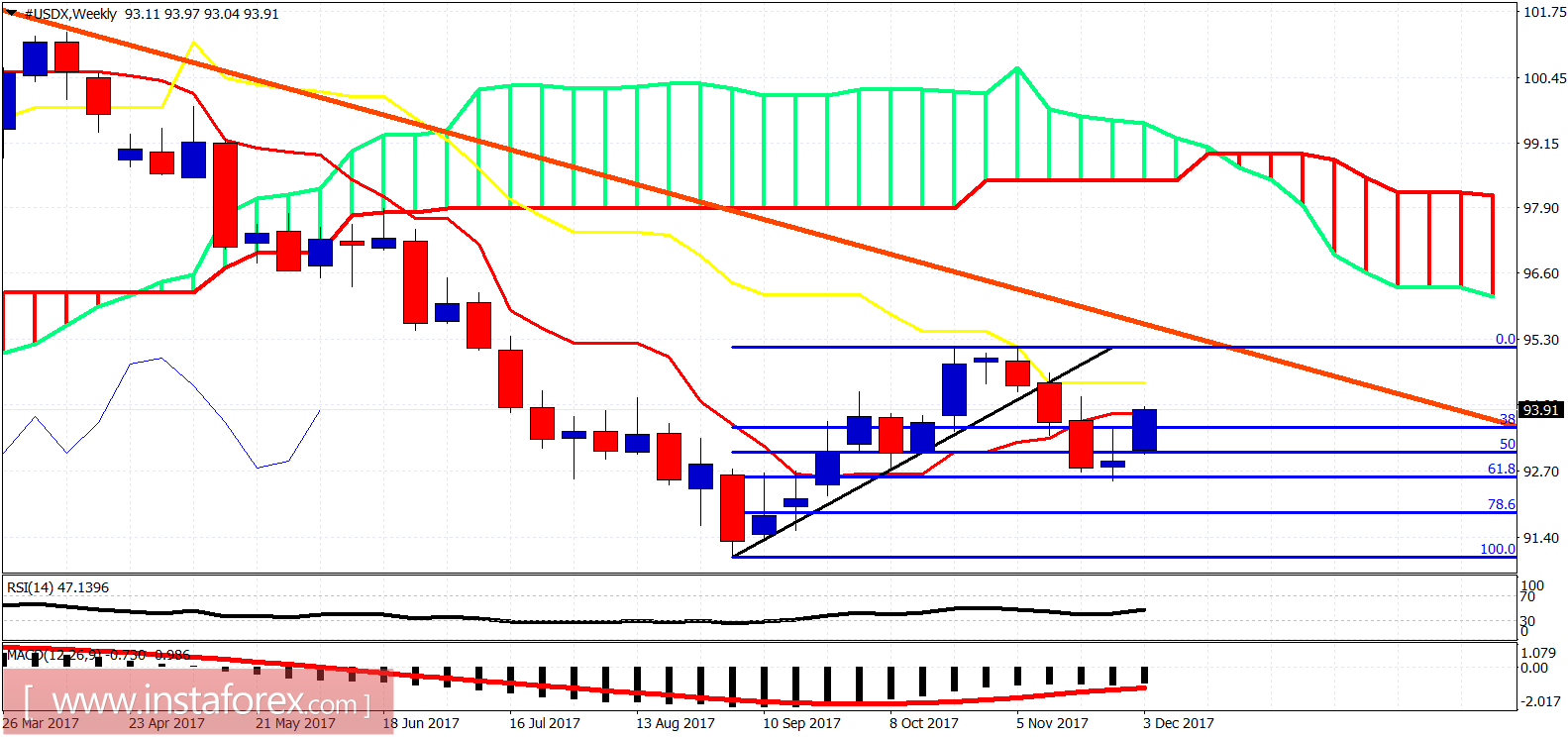

The Dollar index continues higher as expected but we could see a pull back towards 93 today or Monday. Trend remains short-term bullish. We could see a short-term pullback for a higher low before the continuation of the bigger bounce higher towards 96.

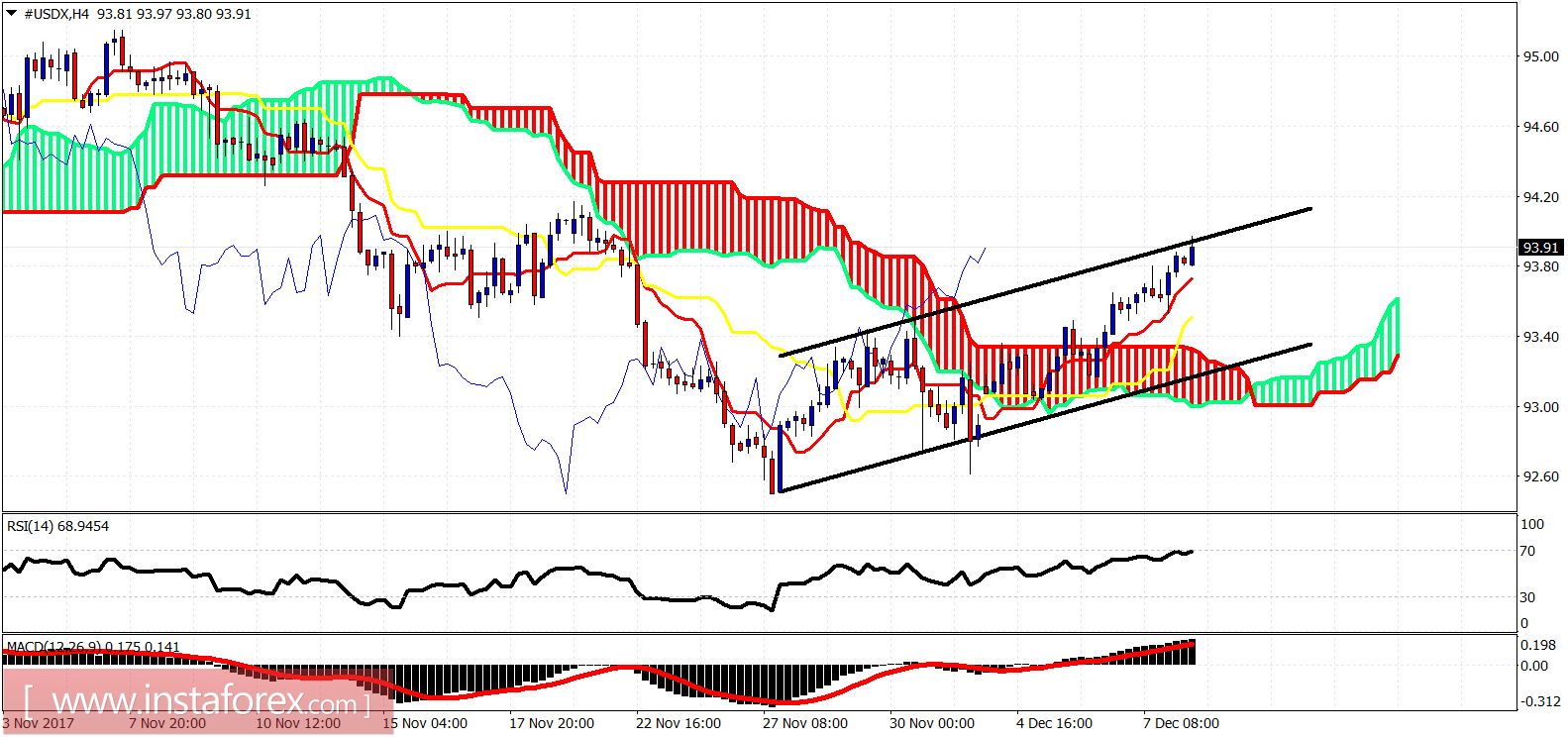

The Dollar index is testing upper channel boundary resistance. Trend is bullish. We could see a pullback towards cloud support at 93.40-93 but overall I believe we have started our next leg up towards 96. Important support is at 93 by the Ichimoku cloud. Bulls do not want to see this level broken downwards.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română