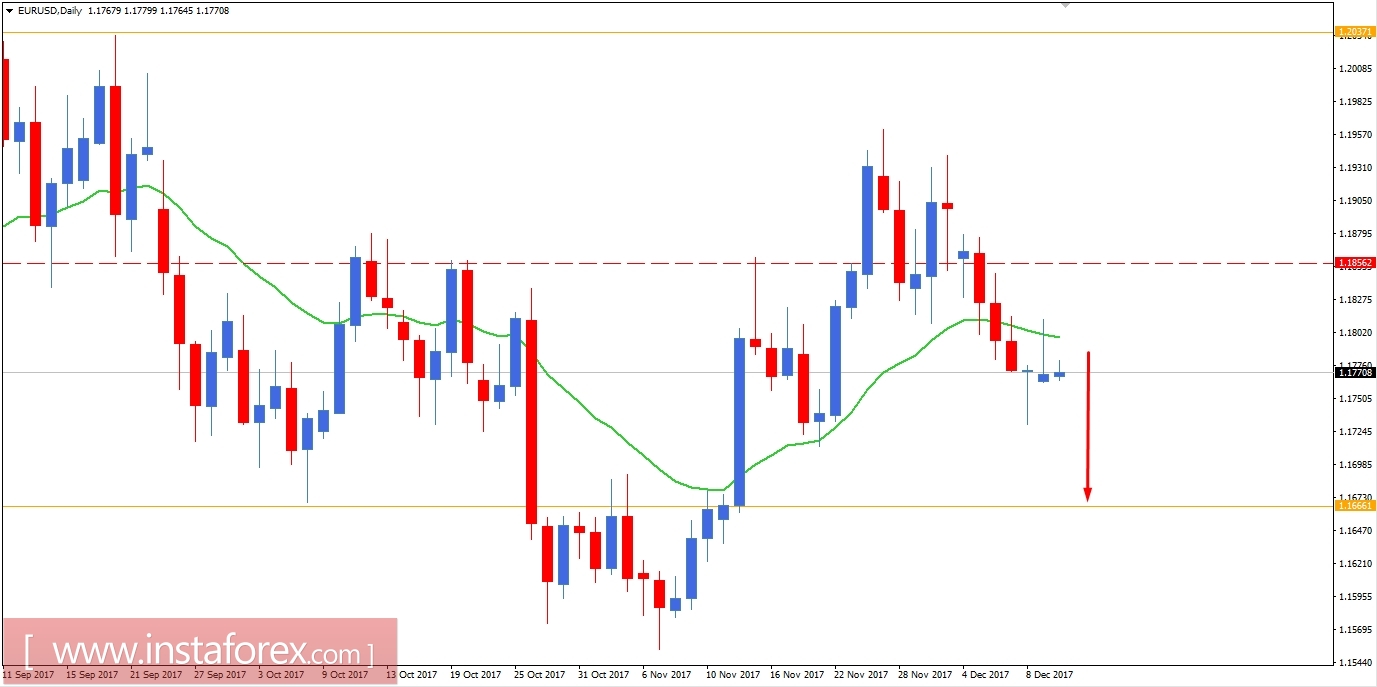

EUR/USD has been trading lower after breaking below the 1.1850 event level recently. Yesterday, EUR tried to gain some momentum against USD but failed to sustain the gain against the dynamic level of 20 EMA and 1.1800 resistance area, resulting in bearish pressure. This week is going to be very volatile for EUR/USD as traders are focused on the FOMC Statement, Economic outlook, and Federal Funds Rate report which are to be published on Wednesday. Moreover, traders are betting on the Fed raising the key interest rate to 1.50% from the previous value of 1.25%. If that happens, USD is expected to be more impulsive with the gains against EUR leading to a further decline of the pair, taking the price much deeper in the coming days. Today, France's Private Payrolls report is going to be published which is expected to be unchanged at 0.2%, German ZEW Economic Sentiment is expected to decrease to 17.9 from the previous figure of 18.7, and ZEW Economic sentiment is expected to have a slight decrease to 30.2 from the previous figure of 30.9. On the USD side, today PPI report is going to be published which is expected to be unchanged at 0.4% and Core PPI is expected to decrease to 0.2% from the previous value of 0.4%. Though the forecast is quite mixed in nature currently, but any positive reading will provide USD with support in the coming days. As for the current scenario, USD is expected to gain good momentum later this trading week that is expected to lead the price towards 1.15 support area in the coming days.

Now let us look at the technical chart. The price is currently residing below the dynamic level of 20 EMA and 1.1800 price area which is expected to push the price lower towards 1.1660 and later towards 1.1500 support area in the coming days. The rejection off the dynamic level indicates that the bearish trend players are still in the market and ready to push the price lower when the rate hike decision strikes on Wednesday this week. As the price remains below 1.1850, the bearish bias is expected to continue further.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română