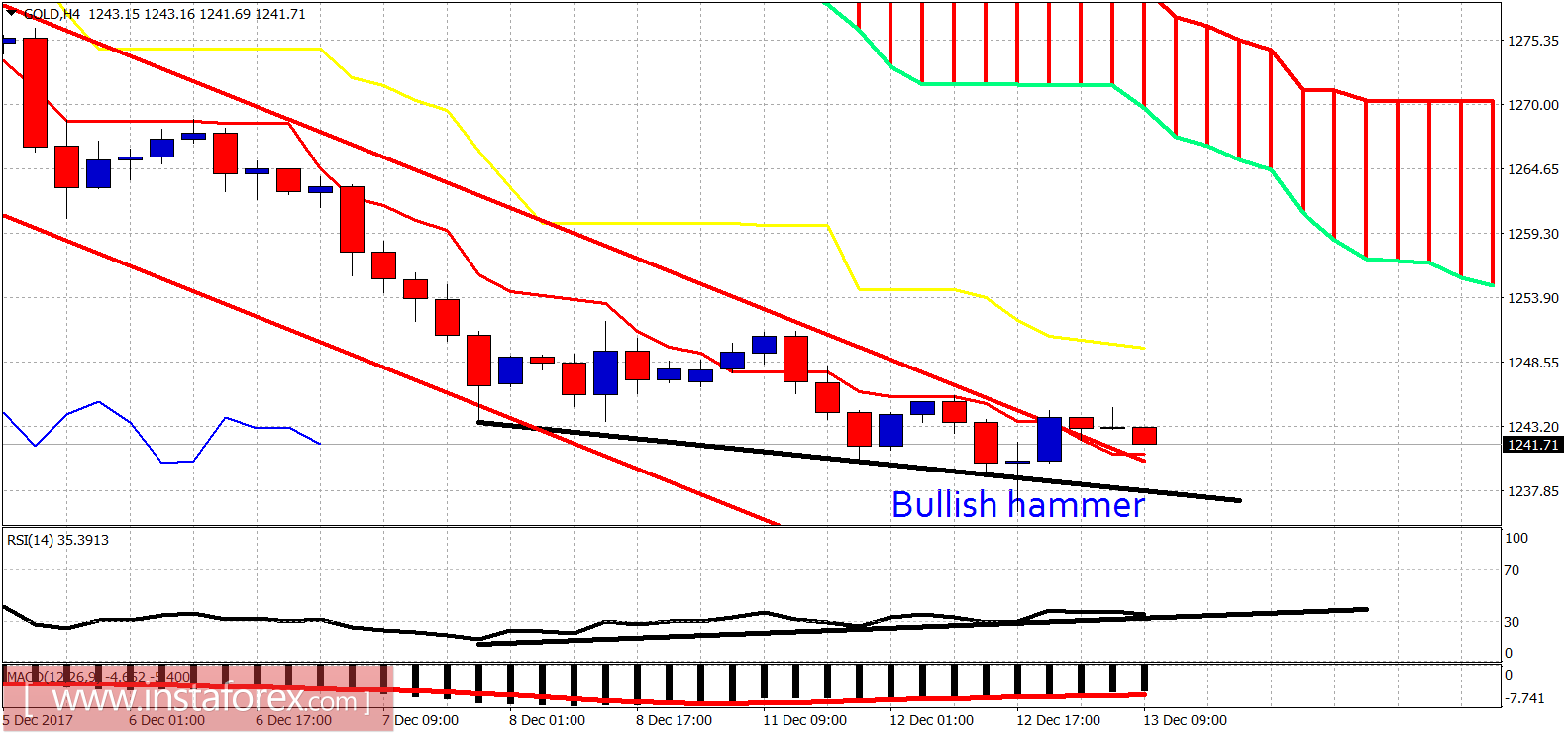

Gold price remains in a bearish trend but yesterday we observed the bullish divergence in the RSI together with a candlestick reversal pattern. Price has the potential to rise to $1,260 today.

Black lines - bullish divergence

Gold price has broken out of the bearish channel and is now back testing it. The RSI is warning bears that the downside momentum has weakened. The 4-hour candle pattern of a bullish hammer is usually a trustworthy reversal pattern. Resistance is at $1,247. Breaking above it will confirm the reversal pattern and push price towards cloud resistance at $1,255-60.

On a daily basis Gold price has also made a bullish hammer. With FOMC tonight we expect Gold price to be volatile. If price is near $1,260 before the FOMC, I would prefer to be neutral as we might see another leg down towards $1,220-$1,200.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română