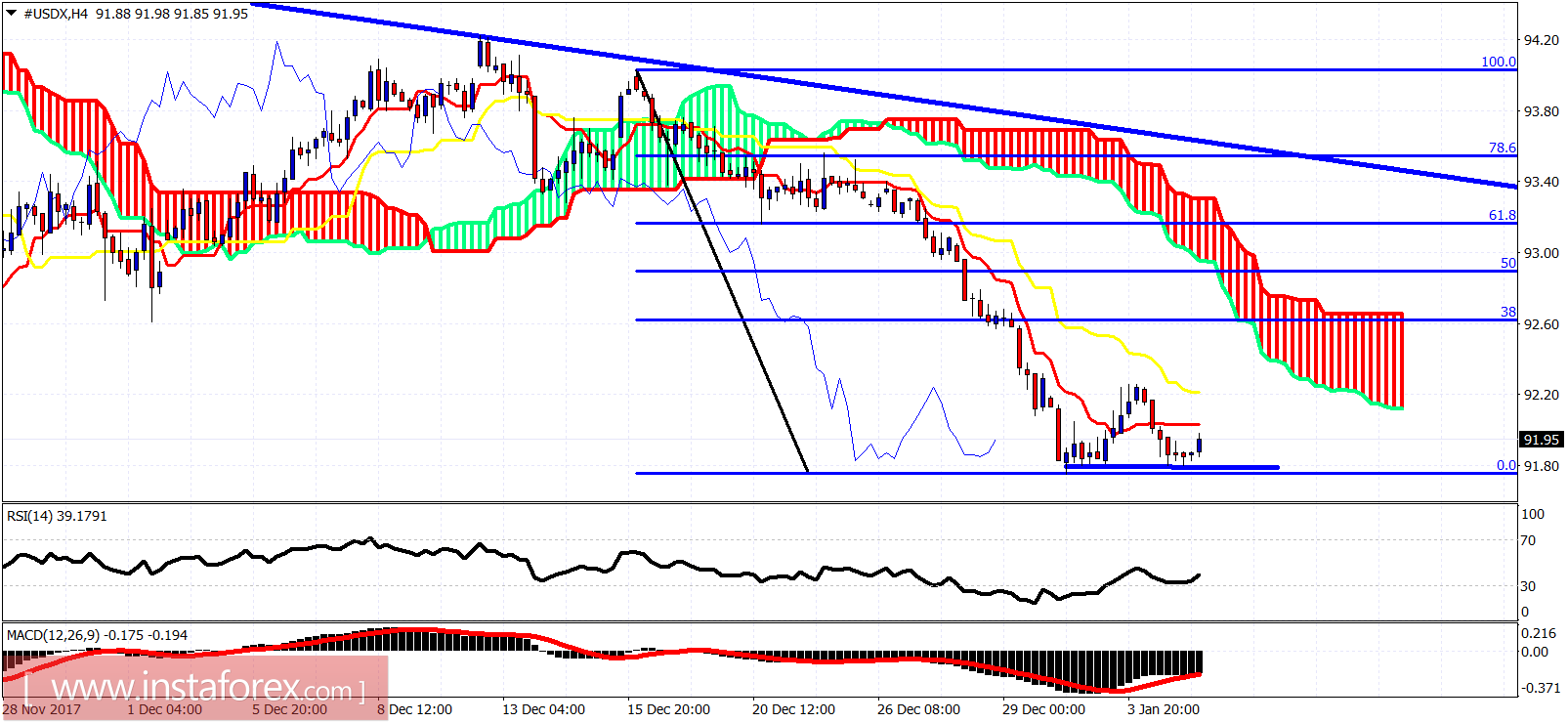

The US dollar index is showing reversal signs after retesting the recent low at 91.75 and the forming a double bottom pattern. As long as we are above 91.75, we could see a bounce towards the 92.70-92.50 area.

Downward sloping blue line - resistance

The US dollar index is expected to bounce at least towards the 38% Fibonacci retracement near the Ichimoku cloud at 92.60 over the coming days. The double bottom formation, as long as it is not broken downwards, should give the dollar a push higher.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română