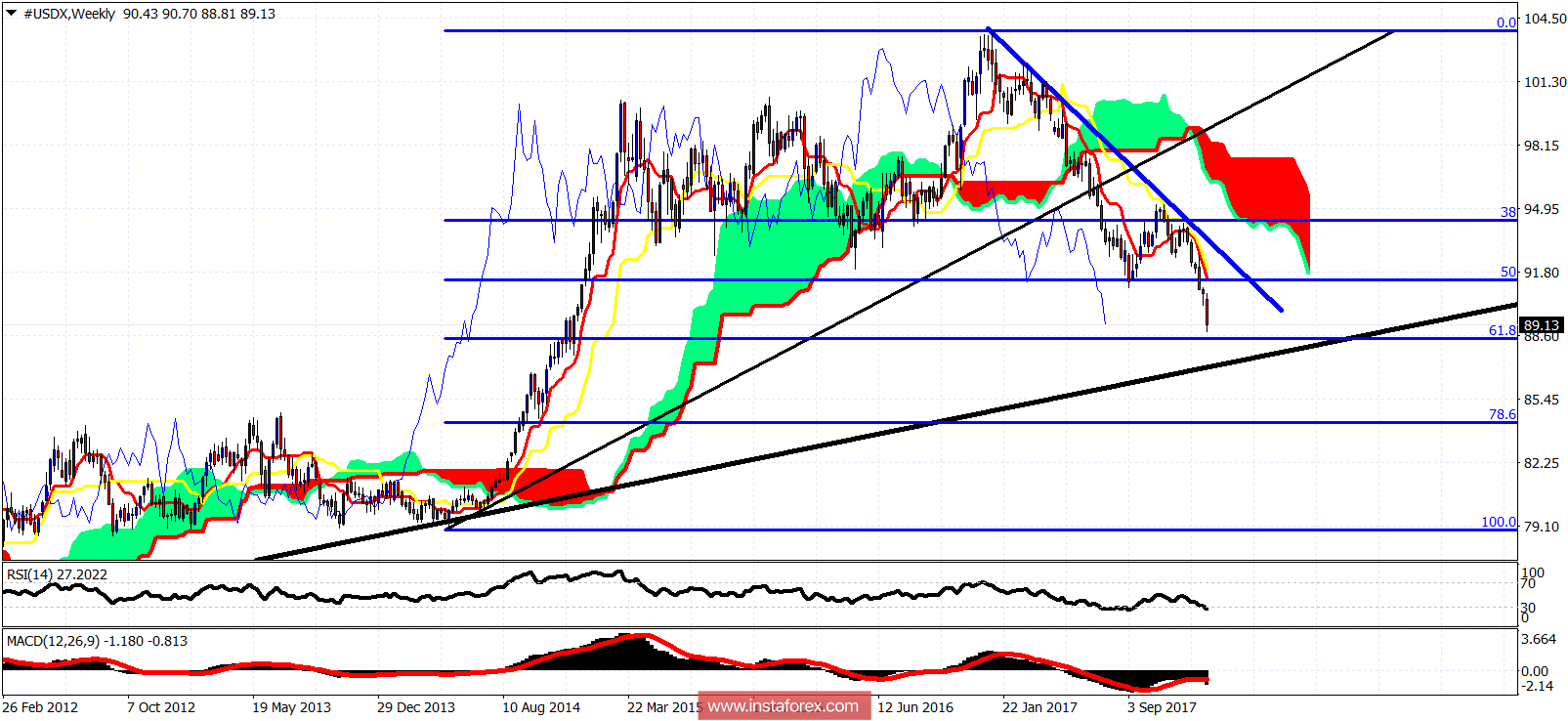

The Dollar index has reached our lower targets. Price remains in a bearish trend. The strength of the decline in the Dollar index has broken the bullish divergence signals. The Dollar index is approaching important Fibonacci support levels.

The Dollar index is trading below both the tenkan- and kijun-sen indicators. Resistance is at 89.45-89.77. Support is at 88.80 and next and most important at 88.50.

On a weekly basis the Dollar index is in a bearish trend. I believe we are close to the end of the downward move from 103. Important support level is at the 61.8% Fibonacci retracement at 88.50 and at the black trend line support at 87. I expect price to bounce strongly towards 92-94 area once this decline is over around 87-88.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română