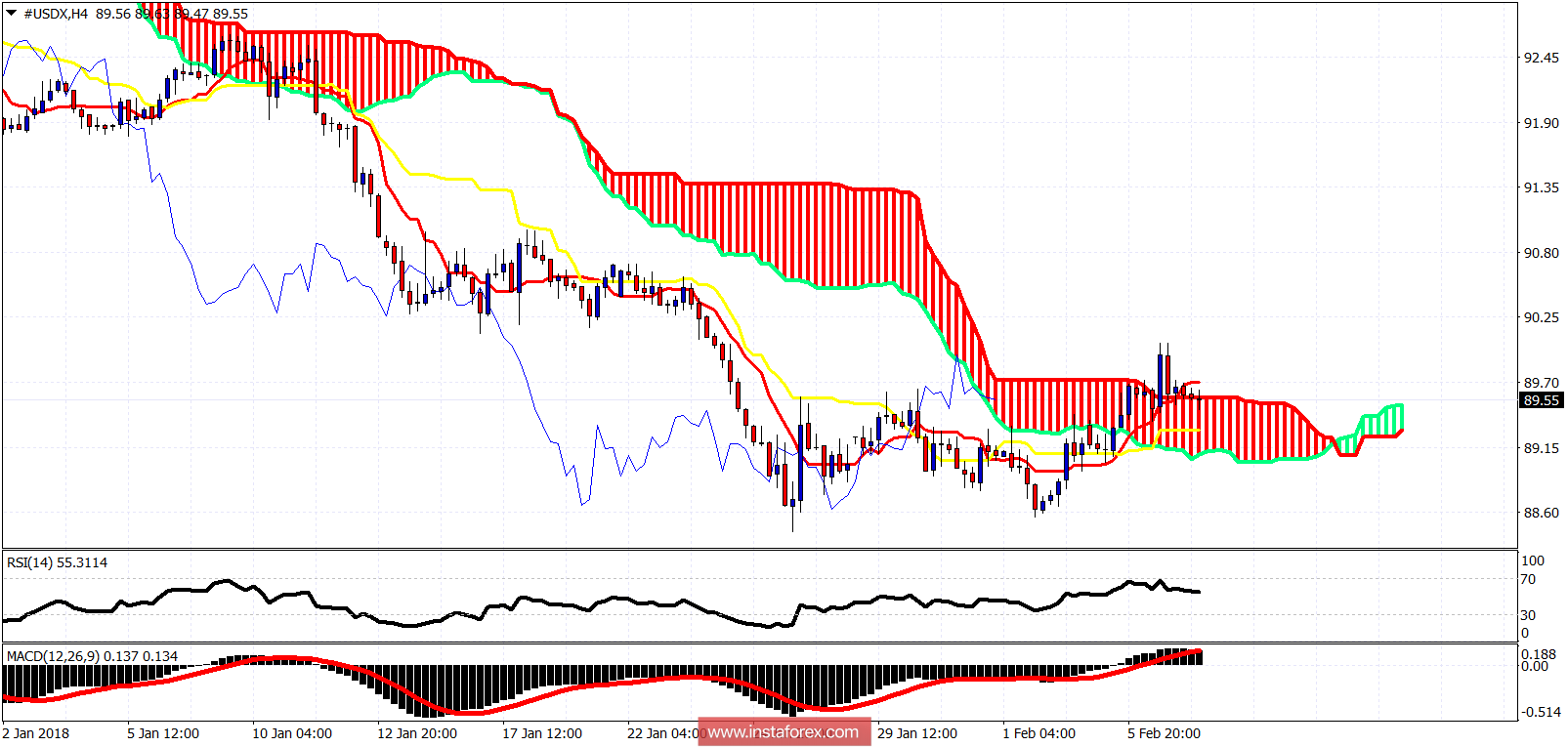

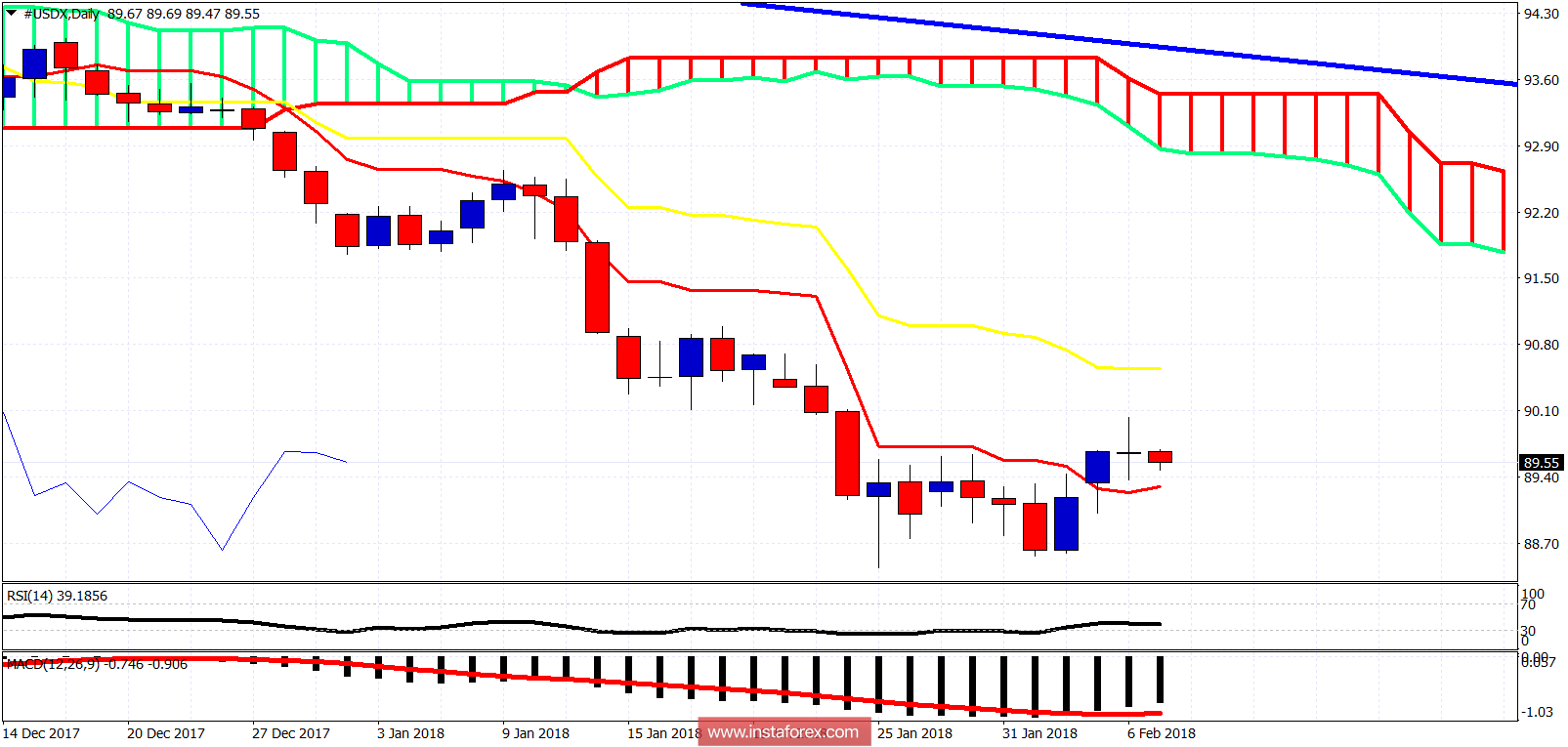

The Dollar index is showing short-term reversal signs. Price has broken out and above the 4-hour Kumo (cloud) resistance. Price is now back testing the cloud support (previous resistance) and is expected to move higher towards 91.

The Dollar index has short-term support at 89.60-89.50 which was previous resistance. This is also where the cloud is now. The kijun-sen support is now at 89.30. Bulls do not want to see a 4 hour close below this level. Resistance is yesterday's high. Break above 90 and we are off to 91.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română