Daily Outlook

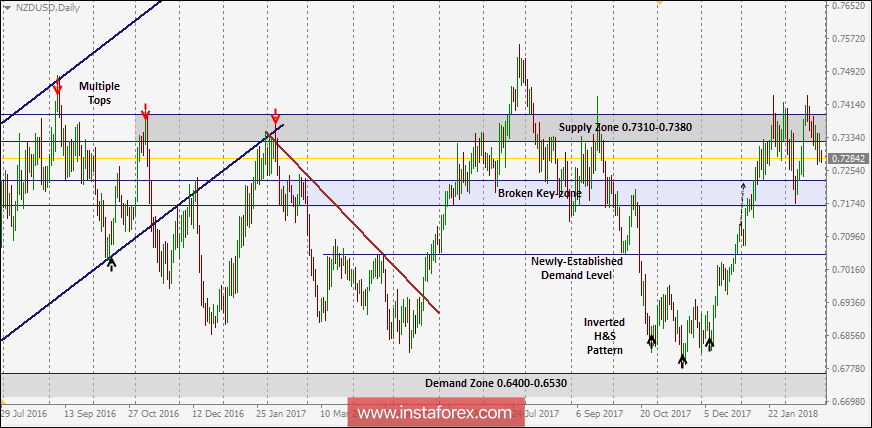

In July 2017, an atypical Head and Shoulders pattern was expressed on the depicted chart which indicated upcoming bearish reversal.

As expected, the price level of 0.7050 failed to offer enough bullish support for the NZD/USD pair. That's why, a further decline was expected towards 0.6800 (Reversal pattern bearish target).

Evident signs of bullish recovery were expressed around the depicted low (0.6780). An inverted Head and Shoulders pattern was expressed around these price levels.

The price zone of 0.7140-0.7250 (the prominent supply zone) failed to pause the ongoing bullish momentum. Instead, a bullish breakout above 0.7250 was expressed on January 11.

That's why, a quick bullish movement was expected towards the depicted supply zone (0.7320-0.7390) where evident bearish rejection and a valid SELL entry were expected.

On February 2, a bearish engulfing daily candlestick was expressed off the price level of 0.7390. Moreover, a double-top reversal pattern was found around the price zone (0.7320-0.7390).

This enhances the bearish scenario towards the price levels of 0.7230 - 0.7165 where bullish recovery should be expressed.

Trade Recommendations:

The current price zone (0.7320-0.7390) remains a significant supply zone to offer a vaid SELL entry.

Stop Loss should be set as a daily candlestick above 0.7380.

Bearish persistence below 0.7300 should be maintained to allow a further decline towards 0.7160 and 0.7090.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română