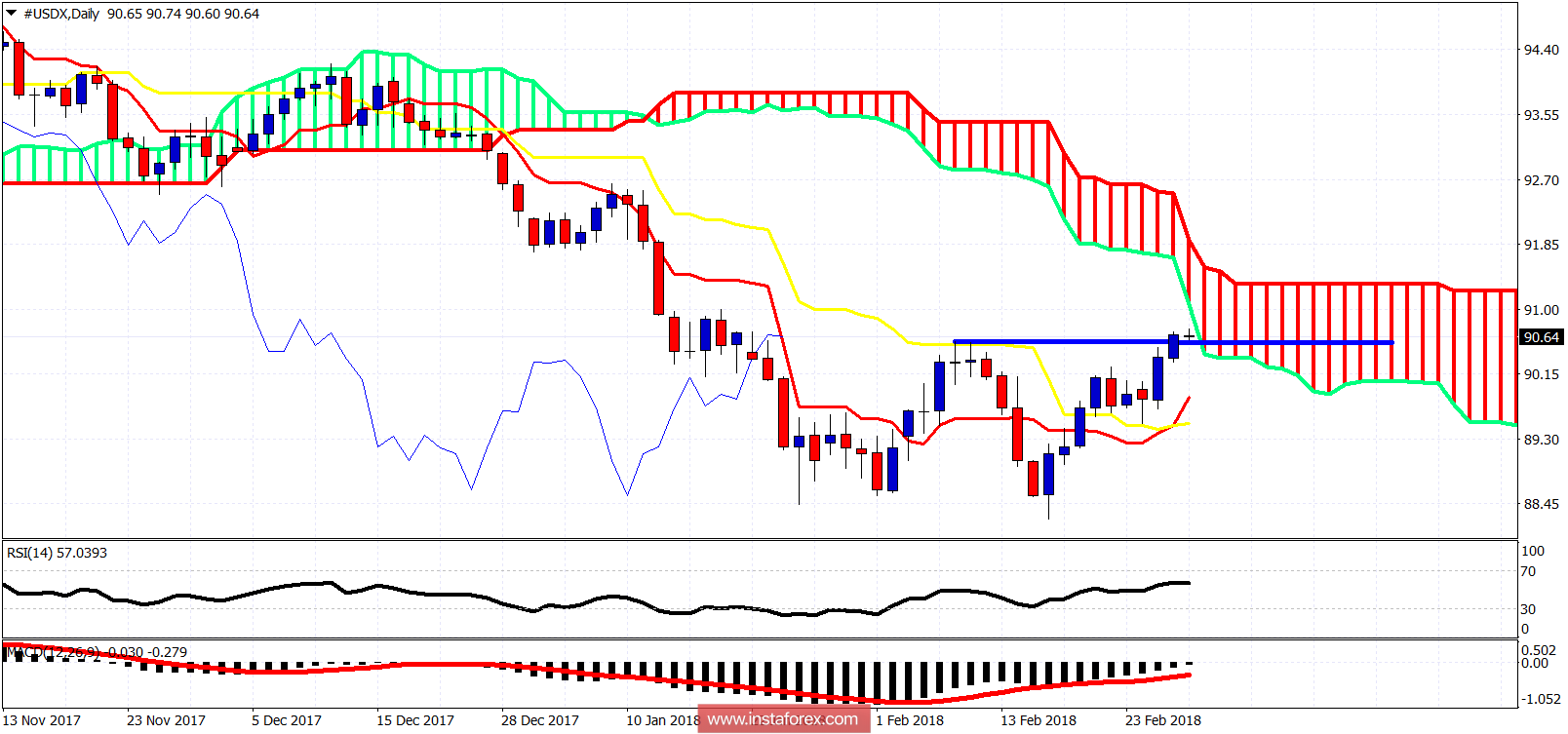

The Dollar index has broken through the previous high at 90.60. Short-term trend remains bullish. Next important resistance is found at 90.85 where we find the 38% Fibonacci retracement.

Black line - resistance (broken)

The Dollar index is breaking above the short-term resistance levels and continues to trade above both the tenkan- and kijun-sen indicators. Support is at 90.10 and at 89.80. Bulls do not want to see these two levels broken. Above the 38% Fibonacci retracement resistance, we have the 91.75 and 92.45 levels as very important resistance levels.

Daily trend remains bearish as price remains below the Kumo. Price is now challenging cloud resistance in the Daily chart. Daily support is at 90.50-90.25 and at 89.80. Bulls need to be careful as we might see a rejection at the Daily cloud resistance.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română