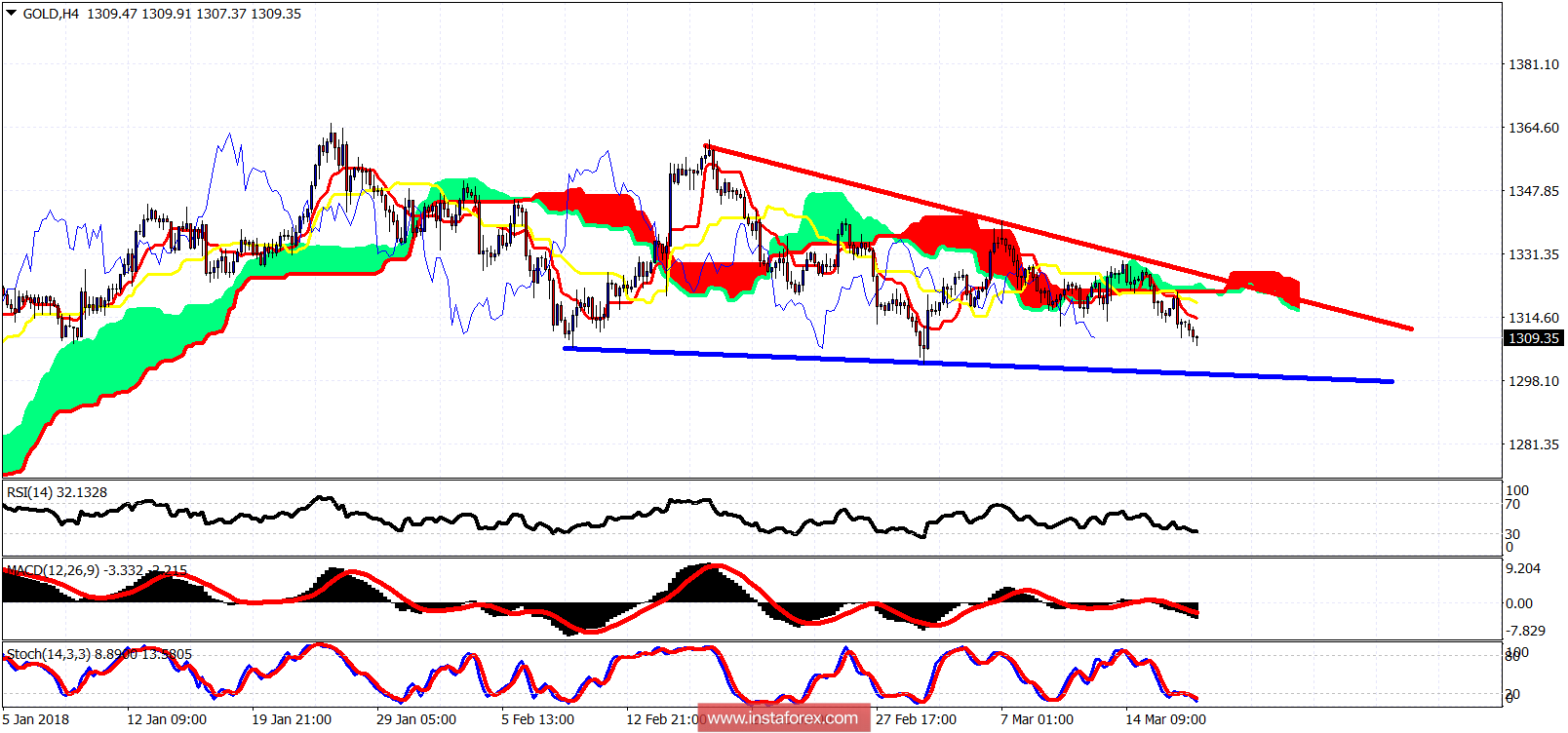

Gold is in a bearish trend. The price is below the Ichimoku cloud on the 4 hour chart and it is challenging the lower boundary of the recent trading range it's been in. I believe it is more probable to see a break below towards $1,280 than the start of a new upward move from current levels.

Red line - resistance

Blue line - support

Gold is facing a short-term support at $1,300 and resistance at $1,326. The trend is bearish as the price is below the Kumo and below both the Tenkan- and Kijun-sen indicators. I expect the lower blue line to be challenged and eventually broken to the downside.

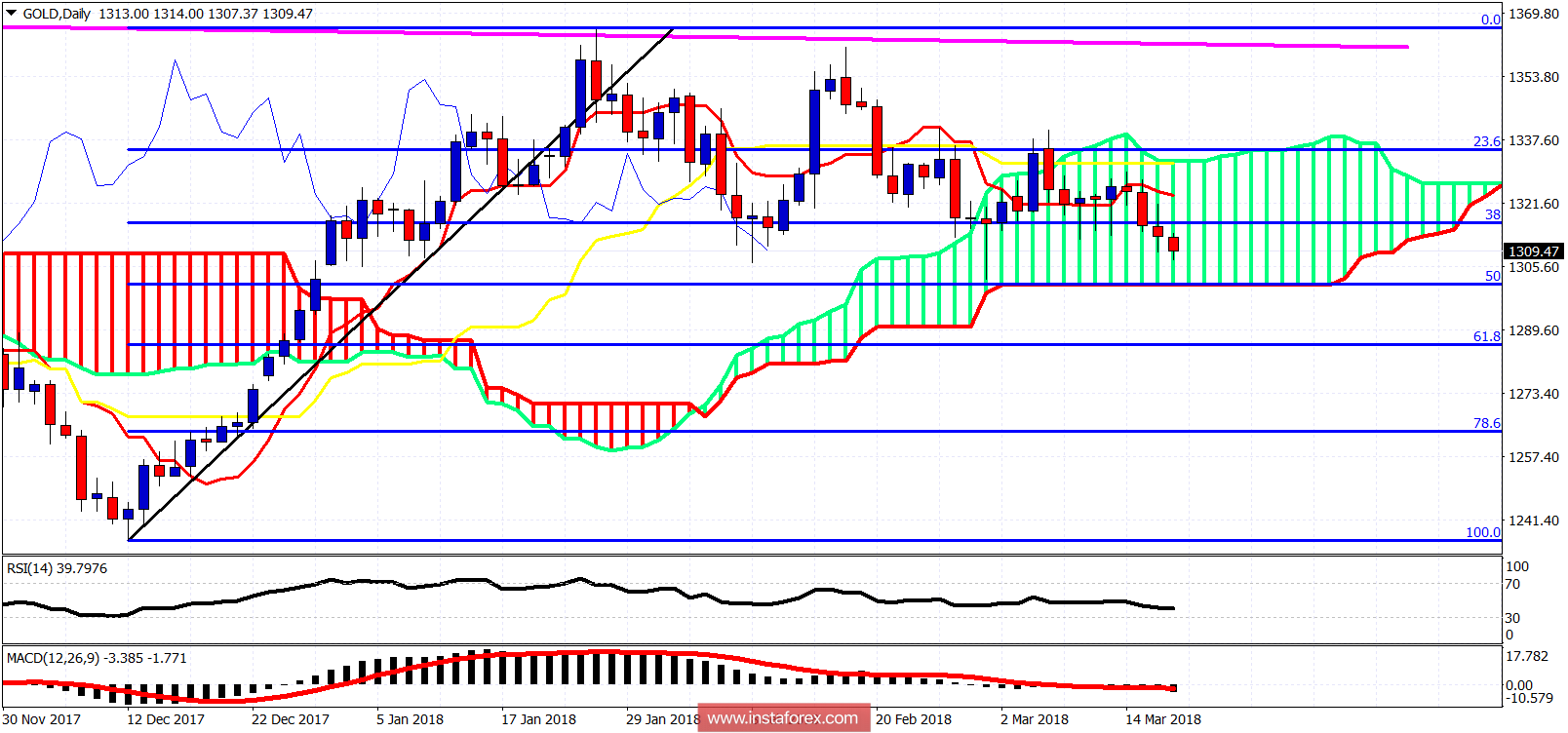

Gold price is in a multiweek sideways corrective move. I believe we are at the final stages of the correction of the rise from $1,236. I expect that we are going to test at least the lower cloud boundary but we are also going towards the 61.8% Fibonacci retracement for a major low before the start of the next leg that will bring the price above $1,400. So, I will be focusing on where the next major low is rather than trading the short-term trend now.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română