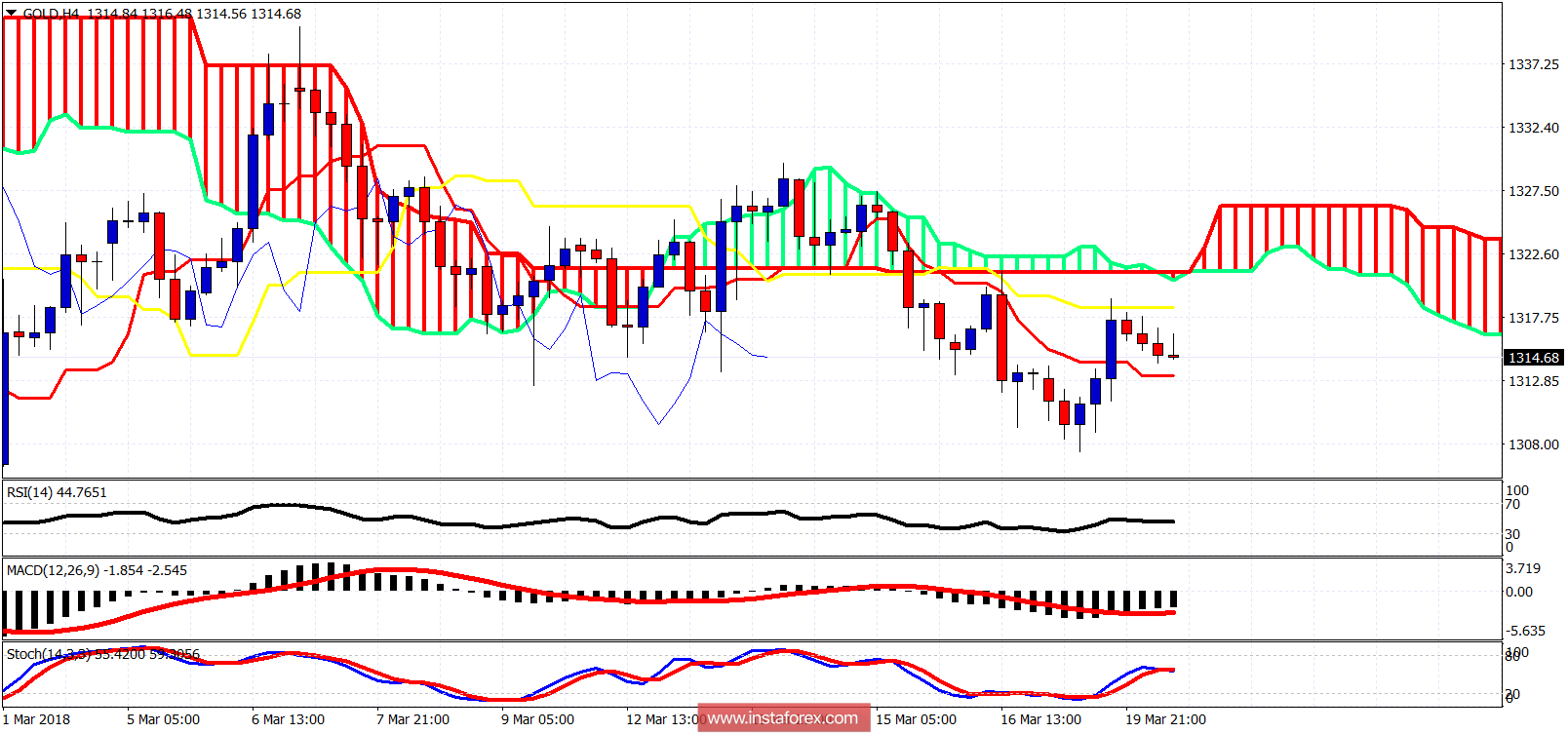

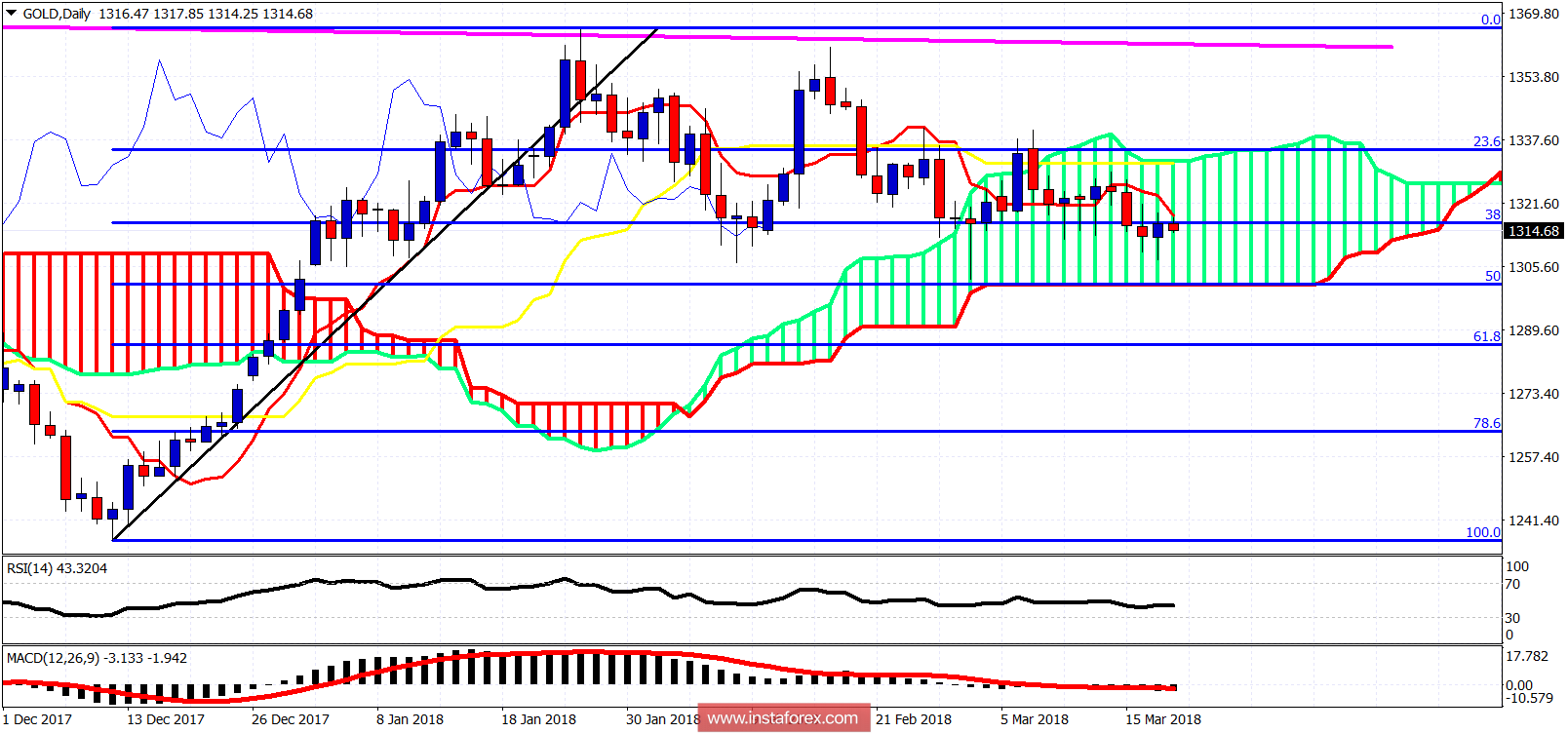

Gold price bounced yesterday but got rejected at the kijun-sen. Short-term trend remains bearish as price remains below the Ichimoku cloud. Medium-term trend remains neutral as the daily candles remain inside the Kumo and still inside the $1,350-$1,300 trading range.

Short-term support is at $1,313 where the 4-hour tankan-sen is found. Resistance is at $1,318.50 (kijun-sen) and at $1,321.50 (Kumo). Trend remains bearish in the short term. Price continues to mainly move sideways between $1,350-$1,300.

On a daily basis, Gold price is in a neutral trend as price is inside the Kumo. Resistance is at $1,334 and support at $1,300 where we also find the 50% Fibonacci retracement. If the support at $1,300 is breached, we should expect at least a move lower towards the 61.8% Fibonacci retracement. On the other hand, in case the resistance at $1,334 is broken, we could see a test of the long-term resistance at $1,350.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română