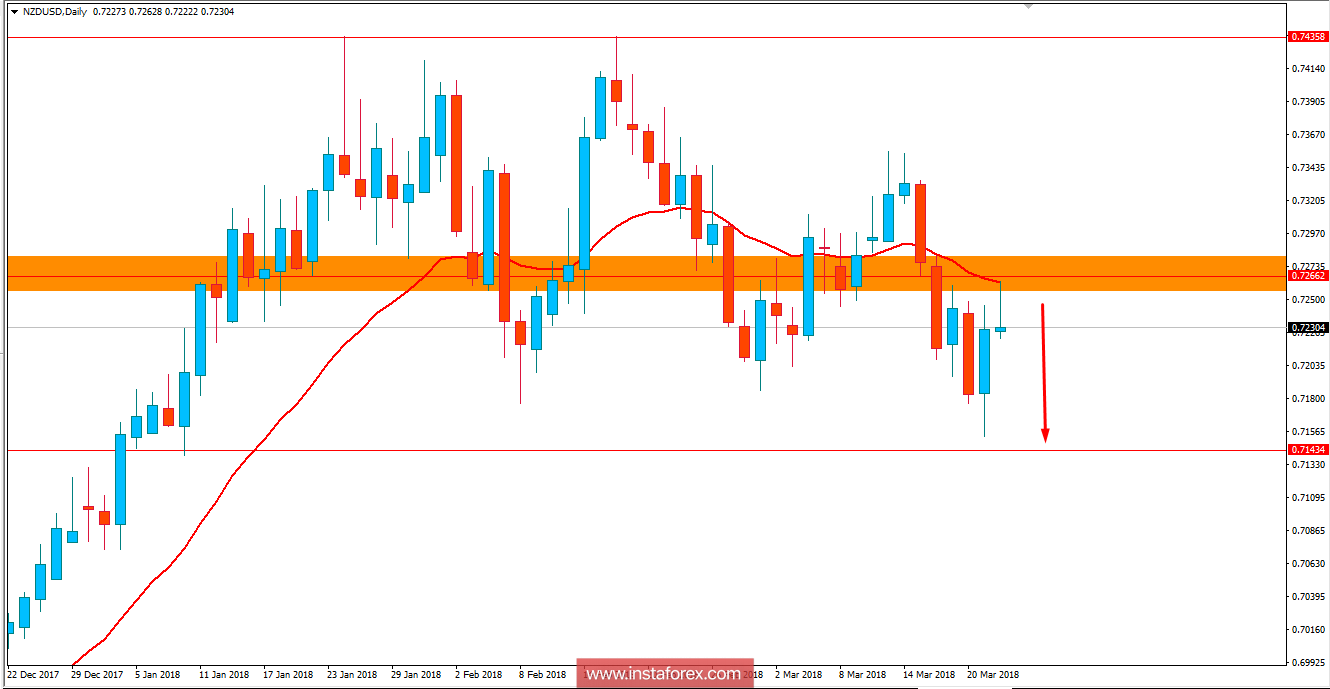

NZD/USD has been quite impulsive with the bullish momentum recently. The pair failed to keep momentum, having rejected off the 0.7250 resistance area today. In light of yesterday's funds rate hike, USD confounded traders' expectations and weakened that led the price higher towards 0.7250. At present, the price is showing some bearish pressure with an intention to proceed lower towards 0.7150 in the coming days. This week, NZD has been quite strong amid economic reports. Visitor Arrivals report showed an increase to 2.0% from the previous value of 0.1% and Westpac Consumer Sentiment showed the index growing to 111.2 from the previous figure of 107.4. On the other hand, today US Unemployment Claims report was published with an increase to 229k from the previous figure of 226k which was expected to decrease to 225k and HPI report showed an increase to 0.8% which was expected to be unchanged at 0.4%. Moreover, today US Flash Manufacturing PMI report is yet to be published which is expected to increase slightly to 55.4 from the previous figure of 55.3, Flash Services PMI report is expected to be unchanged at 55.9 and CB Leading Index is expected to decrease to 0.5% from the previous value of 1.0%. As for the current scenario, USD is expected to gain impulsive momentum over NZD with a view of long-term gains along the process. As the recent rate hike backfired completely for USD, certain momentum towards USD is more probable in the coming days.

Now let us look at the technical view. The price has recently retested the 0.7250 price area with today's daily close where the price is expected to proceed lower towards 0.7150 as the first support and later 0.68 is expected to be a strong support for the longer target. As the price remains below 0.7250 with a daily close, the bearish bias is expected to continue further.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română