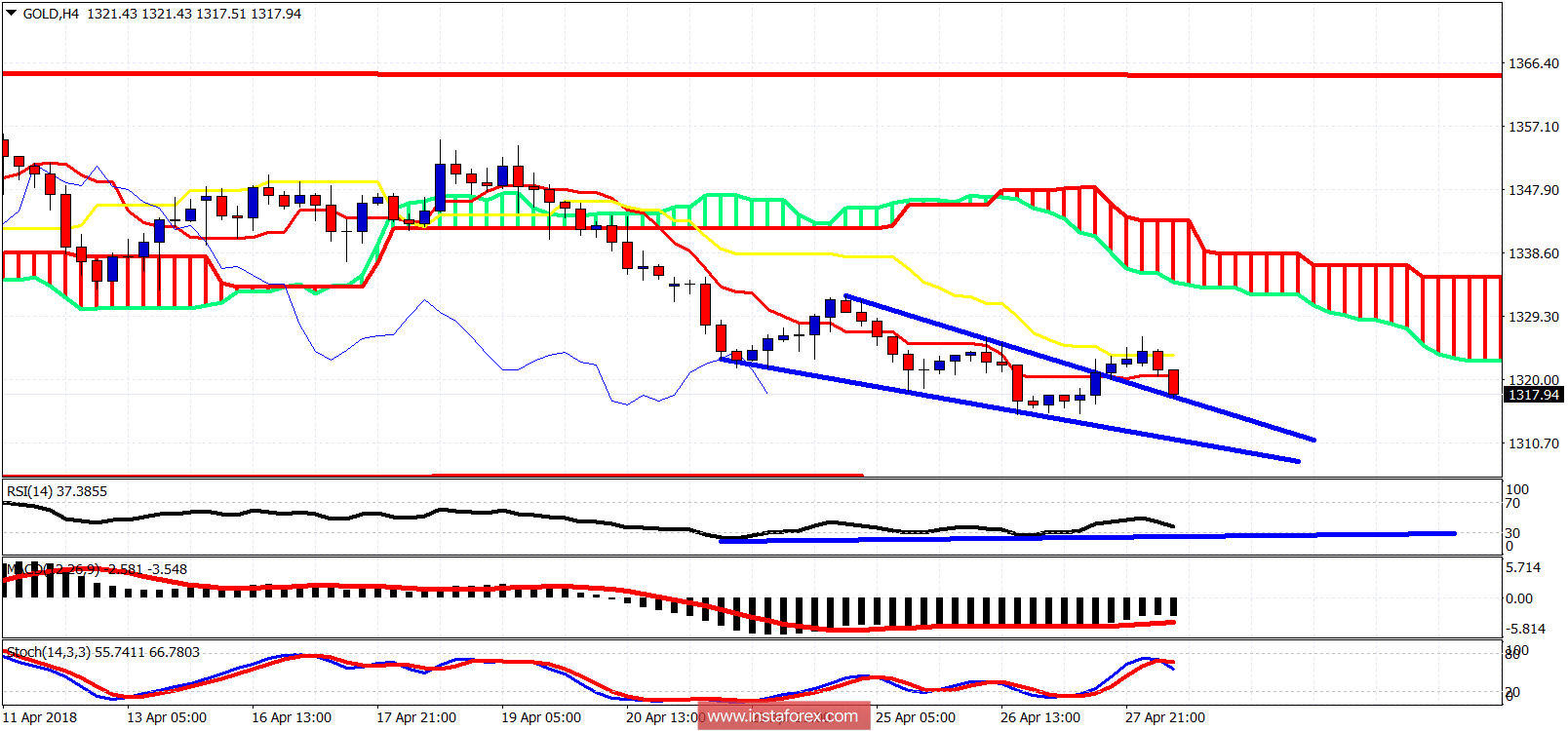

The gold price has broken above the downward sloping wedge pattern and is now back-testing it. Gold could make one more new lower low around $1,311 today before reversing its trend to the upside. The trend remains bearish as the 4-hour candlestick is still below both the tankan- and kijun-sen indicators.

Red line - resistance

Blue lines - wedge pattern

Upward sloping blue line - bullish divergence

The gold price has short-term support at $1,311 where we find the lower wedge pattern boundary. $1,320-24 is short-term resistance. In case of a break above it, we could see a test of the 4-hour cloud at $1,333. The short-term trend changes to bullish on a break above $1,338. I prefer to get bullish on gold around $1,310-$1,300 or with a break above $1,324. I expect the gold price to bounce soon.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română