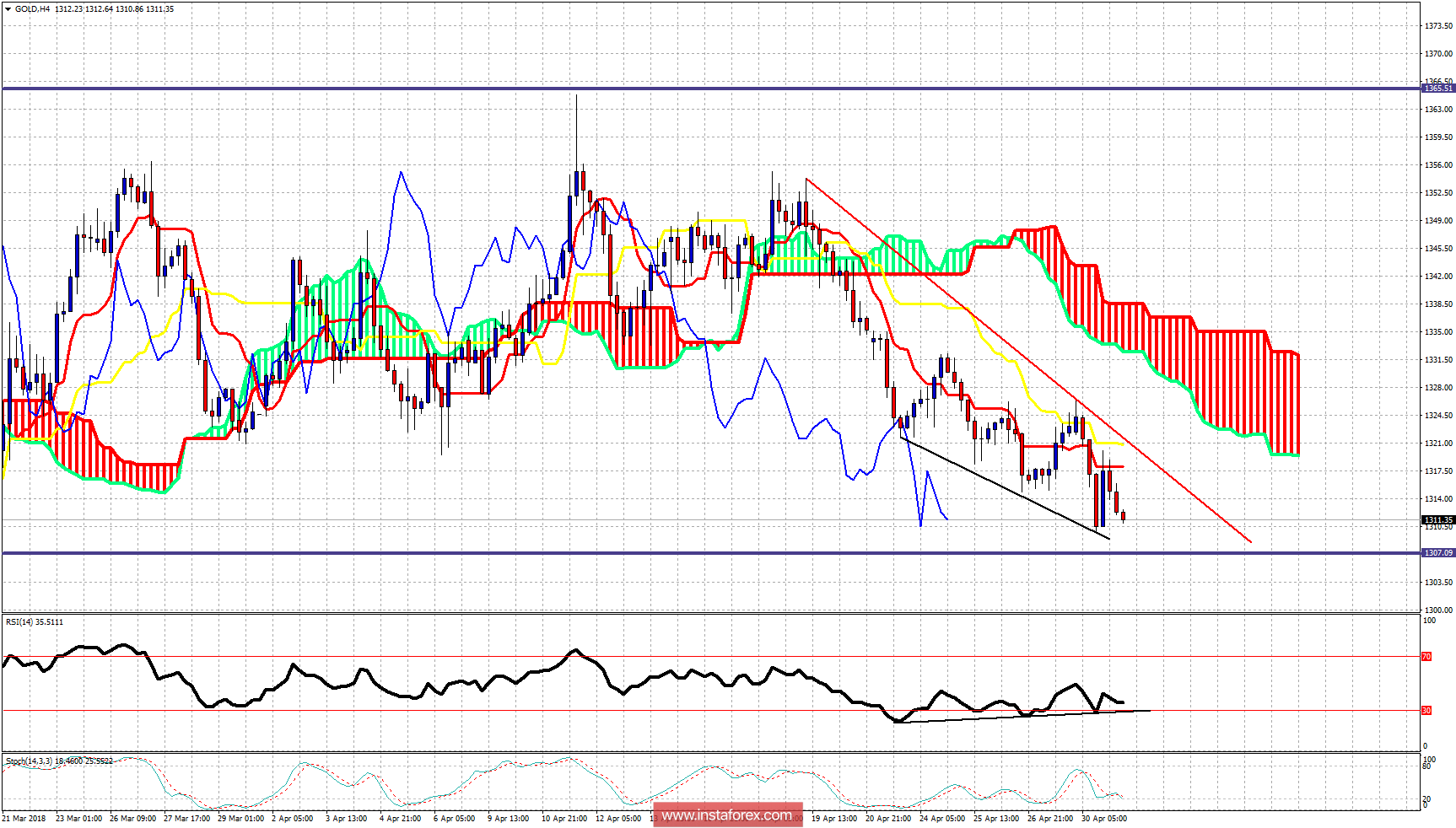

Gold price is still in a down trend. Price remains below the $1,320-25 resistance area that if broken will be the first reversal signal. Support remains at $1,300-$1,310. Gold medium-term trend remains neutral as price is still inside the $1,365-$1,300 trading range. Gold price is showing bullish divergence signs. I expect Gold to provide a big bounce higher.

Blue lines - trading range

Red line - resistance

Black lines - bullish divergence

Short-term resistance is found at $1,317 and most importantly at $1,321. Price got rejected at the 4-hour Kijun-sen indicator (yellow line) yesterday. Bulls need to break above the kijun-sen and the red downward sloping trend line to start a bounce towards $1,332 at least. Downside is limited. I expect price to start a reversal to the upside from $1,310-$1,300 area.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română