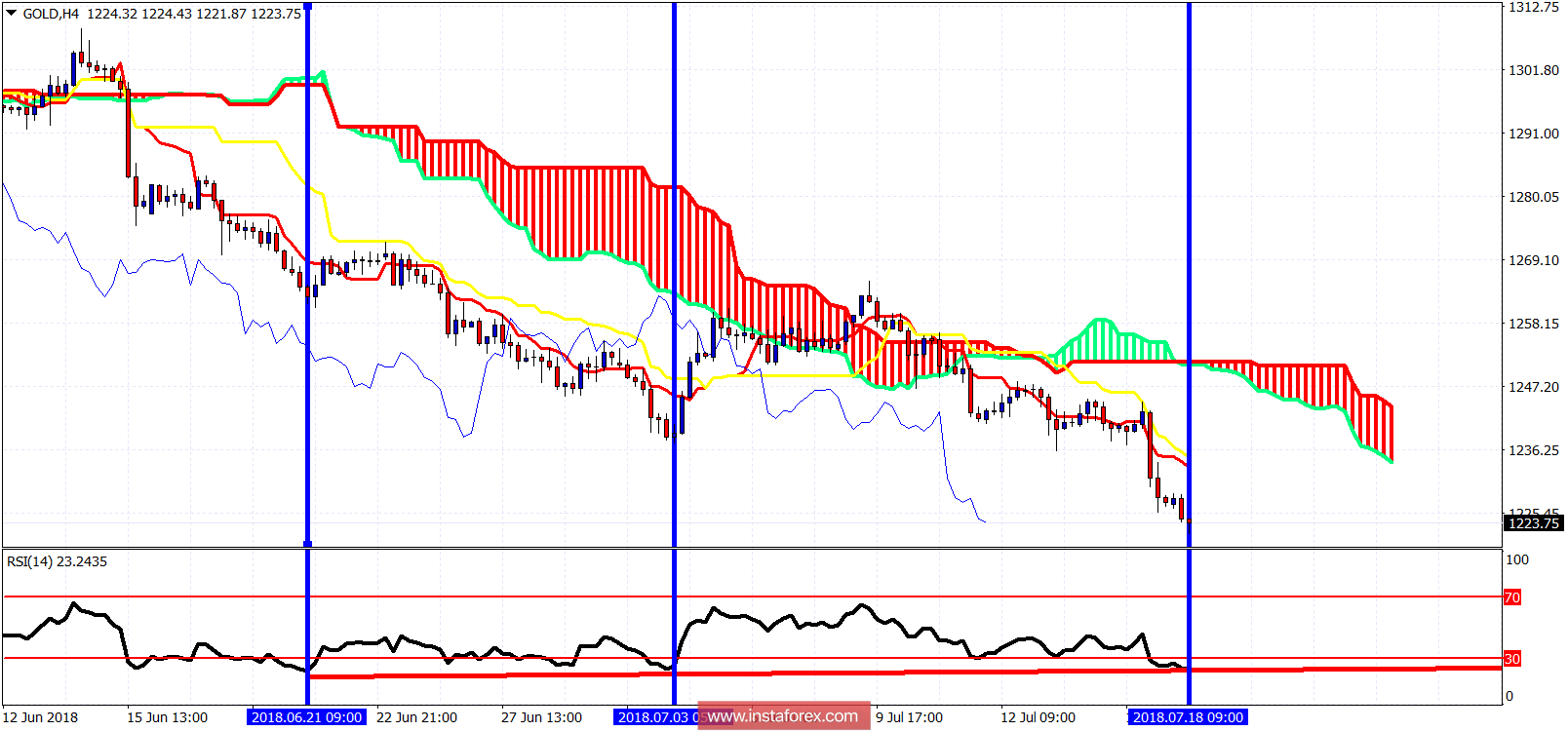

The Gold price is making new 2018 lows. The price is visiting levels last seen in the summer of 2017. The long-term trend line support we showed yesterday has been broken for the time being. Only a weekly close above $1,240 would give Gold bulls hope of a reversal.

Blue lines - the bullish divergence remains

Red line - RSI support/bullish divergence

The Gold price broke below $1,237-35 support area and has visited $1,220 area as expected. Despite the new low the RSI did not make a new lower low. The RSI is at a higher level even since the low made on July 3rd near $1,236. Cloud resistance is found at $1,247 and bulls need to break this level to change short-term trend to bullish again. The RSI is also diverging on a daily basis and is very oversold on a weekly basis as well. This is not the time be chasing a short trade in Gold. At least a bounce towards $1,240-45 will come soon.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română