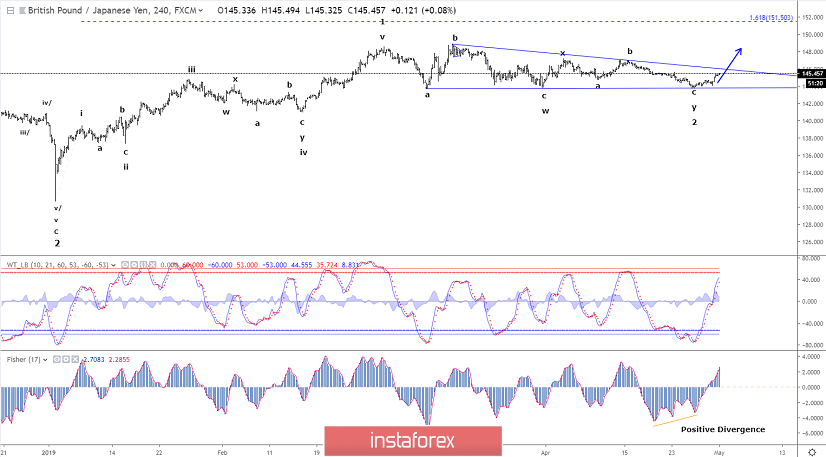

GBP/JPY is pushing nicely higher and should be testing resistance near 146.00 soon. A clear break above here, will confirm that the corrective decline in wave 2 is complete and call for a strong impulsive rally in wave 3 through resistance at 148.50 for a continuation higher to 151.50.

That said, we have an alternative possibility. Under this alternative count, resistance near 146.00 will cap the upside and turn prices lower again. This time support at 143.75 will be broken for a C-wave decline to 141.05 to complete wave 2. We have no reason to lift the alternative count to our preferred count at this point in time, but just alert you to the risk.

R3: 146.65

R2: 145.95

R1: 145.57

Pivot: 145.12

S1: 144.84

S2: 144.39

S3: 144.02

Trading recommendation:

We are long GBP from 144.00 and we will keep our stop at break-even for now.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română