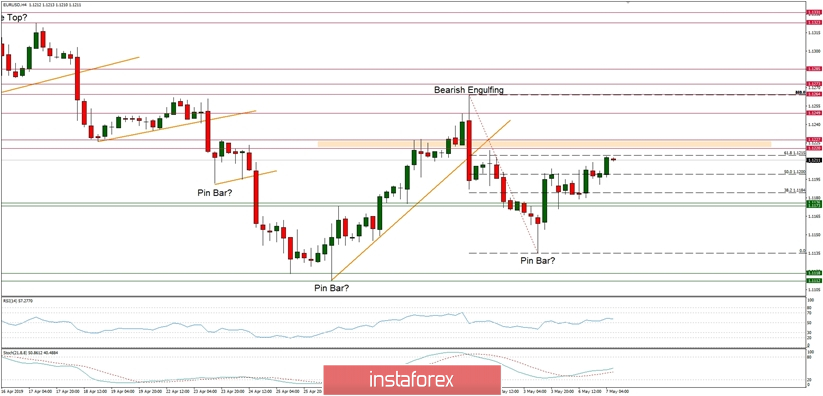

Technical Market Overview:

The EUR/USD pair has made it to 61% of the Fibonacci retracement of the previous wave down and the price is testing the level of 1.1215. This would be a perfect place to terminate the corrective bounce and go back to the downtrend. Any higher movement towards the technical resistance zone located between the levels of 1.220 - 1.227 will increase the odds for the rally towards the swing high at the level of 1.1264 and then the bearish outlook will be invalidated.

Weekly Pivot Points:

WR3 - 1.1382

WR2 - 1.1317

WR1 - 1.1252

Weekly Pivot - 1.1192

WS1 - 1.1128

WS2 - 1.1061

WS3 - 1.0995

Trading Recommendations:

The down move continues, so the best day trading strategy is to short the local upwards corrections at the Fibonacci retracements (like 50% or 61%) or around the technical resistance levels. The target is seen at the wing lows around the level of 1.1112.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română