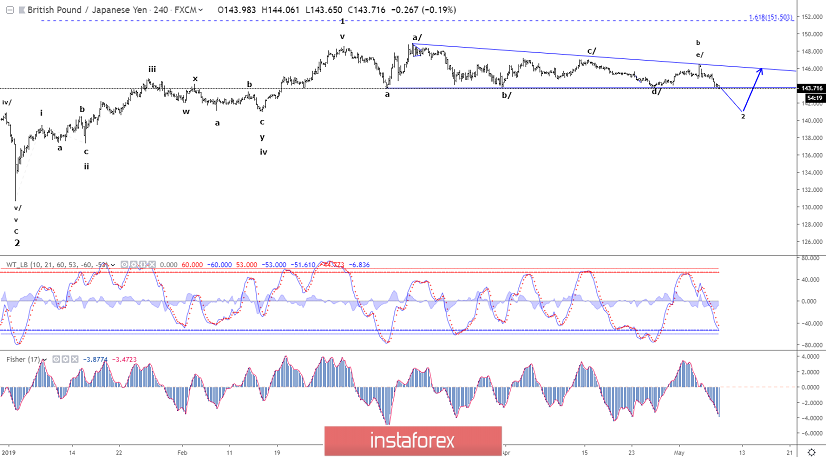

The failure to build on the rally from 143.74 has shifted the alternate count to be our new preferred count. Under this count, we only saw the completion of a triangle wave b at 146.51 peak and wave c of 2 is now in motion. Under this count, wave c should continue lower to 141.05 to complete wave 2 and set the stage for wave 3 higher again.

Resistance is now seen at 143.86 and again at 144.26.

R3: 144.66

R2: 144.26

R1: 143.86

Pivot: 143.74

S1: 143.16

S2: 142.31

S3: 141.75

Trading recommendation:

Our stop+revers at 143.70 has been hit. We need to start by placing our stop all the way up at 145.40. We will take profit at 141.25.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română