EUR has been the dominant currency in the pair while GBP is struggling to regain momentum. Though the eurozone released a series of weak fundamental data, EUR managed to assert strength over GBP.

The ECB has been making efforts to improve the economic infrastructure due to swelling public debt in Italy. The ECB is currently desperate to boost economic growth in the eurozone. Mr. Rehn, the possible successor of current ECB president Draghi, stated that the eurozone's economy is battling with low inflation and weak growth. Such a situation is quite worrisome and alarming for the economy if no steps are taken soon. The ECB can resort even to rate cuts in the coming days if needed.

European Central Bank Vice President Luis de Guindos recently said that the outlook for the euro area economy has deteriorated and policy makers are ready to provide additional monetary stimulus if needed. Additionally, Italian Prime Minister recently claimed that the European Union's fiscal rules should be revised and focus on growth rather than on financial stability. Under current rules, EU states with large public debts should gradually reduce them, but Rome's debt increased last year and is forecast to expand further until 2020.

Today economic reports from the eurozone were published better than expected which includes French, German and Eurozone's Manufacturing & Services PMI reports. The data helped EUR to regain further momentum over GBP.

On the other hand, the UK reported on a larger-than-expected budget deficit last month as government spending rose. It reminds the market that the next finance minister may have limited options to support any Brexit impact on the economy. As for the National Statistics, the budget deficit widened to 5.115 billion pounds. For the first two months of the 2019/20 financial year, the deficit was 18% larger than a year earlier at just under 12 billion pounds. An increase in government borrowing this year after a steady fall in the size of the deficit from around 10% of economic output in 2010 to just above 1% last year.

Recently UK Retail Sales report was published with contraction to -0.5% as expected from the previous value of -0.1%. Besides, the Bank of England kept the key interest rate unchanged at 0.75% as expected. While the UK central bank maintained the volume of the asset purchase facility and monetary policy. Today UK Public Sector Net Borrowing report was published with a decrease to 4.5B from the previous figure of 6.2B which failed to meet the expected reading of a decrease to 3.3B. So, the worse-than-expected result affected sustainable GBP gains at the current price formation.

To sum it up, GBP is unable to gain ground. EUR seems to be more optimistic despite the challenges being faced. Today EUR found support from solid PMIs from leading EU countries.

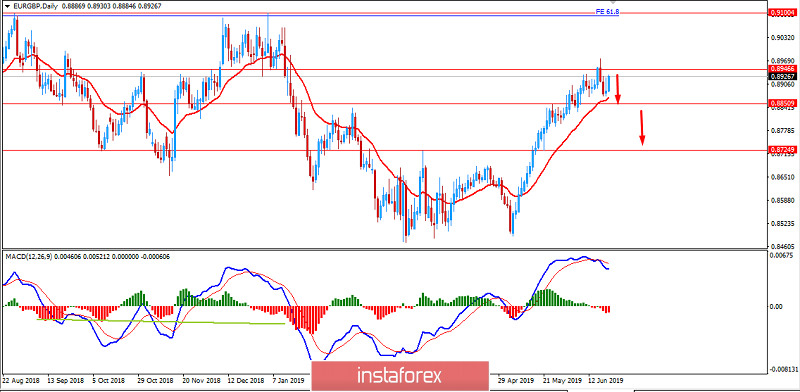

Now let us look at the technical view. The price is being held by the dynamic level of 20 EMA. The pair is now trading below 0.8950-0.90 with a daily close which indicates higher volatility. I expect a strong counter-move with a target towards 0.8850 and later towards 0.8700 support area in the coming days. As the price remains below 0.90 area, the bearish bias is expected to continue further.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română