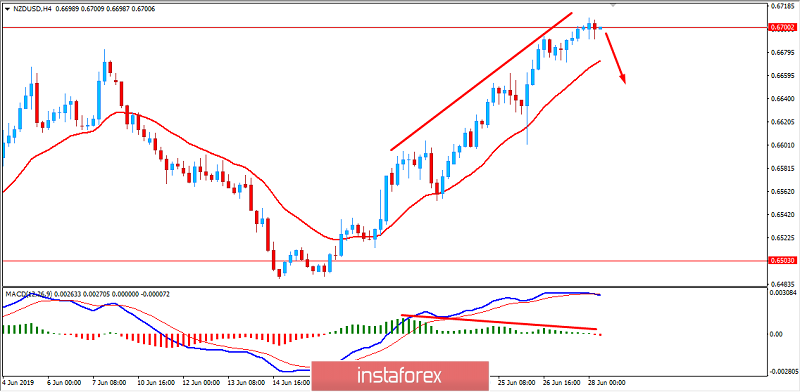

The residing at the edge of 0.6700 area. Some economists suppose that this is a short-term trend and the pair is likely to slide a bit.

The Reserve Bank of New Zealand became the first major central bank to cut its key rates in the latest global shift due to the looser policy. After the meeting in May, the RBNZ has met again in June. It kept the interest rates unchanged at 1.5%.

Recently published New Zealand's economic data were mostly in line with the forecasts. The growth of economy expanded by 0.6% quarter-on-quarter rate in Q1. In March, the reading amounted to 2.6%, its record low since 2014. However, Household Consumption and Business confidence indexes are still showing weakness.

The kiwi remains stable against the US dollar despite weak economic data. ANZ Business Confidence report published recently showed a decrease to -38.1 from the previous figure of -32.0.

At the same time, the Fed feels pressure after the publication of weak economic reports. Trump bombarded the Fed with a new potion of criticism. What is more, trade wars also put pressure on the greenback. Now traders are sitting on the sidelines, awaiting the Fed's meeting in July. Some economists expect that the Federal Reserve may reduce its benchmark interest rate. The Fed is worried about US inflation rate and wants to avoid hyperinflation impact like Japan.

US Final GDP has been finally released. The reading remained unchanged as expected at 3.1% and Final GDP Price Index rose to 0.9% which was also expected to be unchanged at 0.8%. Additionally, US Pending Home Sales report was published. The figure grew to 1.1% as expected from the previous value of 1.5%. Today, the G20 meeting is taking place. Traders are awaiting hints about the future of US-China trade relations.

Meanwhile, the US dollar is likely to regain momentum amid better economic data while the New Zealand dollar may slow down.

Now let us look at the technical view. The price is currently residing at 0.6700 event area where Bearish Divergence is taking place. The price is expected to push lower towards 0.6500 support area. The pair is trading in a bearish channel. However, it is likely to lift up towards 0.70 area in the future.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română