GBP has been struggling to gain momentum against CHF, but the recent economic and BREXIT issues were holding it back. The Bank of England has been in a tightening bias towards a rate cut which is yet to be confirmed by the monthly GDP data.

The monthly GDP growth in the UK was seen to be lower than the previous data, indicating weaker economic growth due to the global slowdown and the ongoing Brexit uncertainties. It is highly possible that the GDP volume decreased in Q2. The BOE is expecting a decline in economic growth due to Brexit issues. The business investment grew by 0.5% in 2019 Q1, although there was more-than-expected uncertainty around the environment. Further on, the household consumption advanced by 0.6% in 2019 Q1 while the Retail sales volumes was flat in April, following three consecutive months of growth.

The annual headline and core CPI inflation inched down slightly in May, to 2.0% and 1.7% respectively. For Q3, the headline inflation was expected to fall to 2% due to the recent fall in energy prices. The employment growth slowed further to 0.1% but the labor market still remains strong. The current account balance showed a decline from -23.7B to -30.0B, beating the expectation of -32.0B. The manufacturing PMI weakened to 48.0 from the previous value of 49.4 while the construction PMI slid to 43.1 from 48.6. The M4 Money Supply index declined to -0.1% from 0.5% and the services PMI dropped to 50.2 from 51.0. The market will absorb the monthly GDP report on Wednesday along with the manufacturing production data.

On the other hand, the main aim of the SNB is to fight against the economic slowdown. That makes the SNB to keep the interest rate unchanged at -0.75%. To support the economic growth, the SNB has shifted the target range for the three-month Libor rate used previously which currently stands at -0.75%. The GDP growth sped up in the first quarter, comparing to all large economies recording above-average expansion. The SNB projected the inflation rate to be 0.7% on a yearly basis which is 0.1% up from the projection of last quarter.

The KOF economic barometer declined from 93.8 to 93.6 while the retail sales decreased to -1.7% from -0.8% on a yearly basis. The manufacturing PMI dropped to 47.7 from the previous value of 48.6 and the CPI declined to 0.0% from 0.3% on a monthly basis. The foreign currency reserves remained mostly unchanged at 759B.

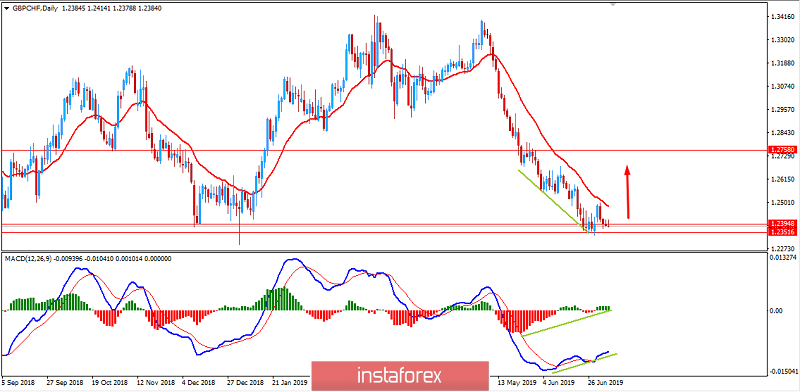

As of the current scenario, the GBPCHF pair might face some correction in coming days according to the market structure, technical & fundamental outlook. To remain bullish in this pair, a strong bullish daily close is needed from the current market price with support from the better-than-expected UK GDP data.

Now let us look at the technical view. The price has recently formed the Bullish Regular Divergence which is expected to push the price higher despite the preceding non-volatile bearish trend in place. The price recently managed to bounce off the 1.2350 area but could not sustain the bullish pressure which indicates further correction before pushing higher towards 1.25 and later towards 1.2750 resistance area in the coming days.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română