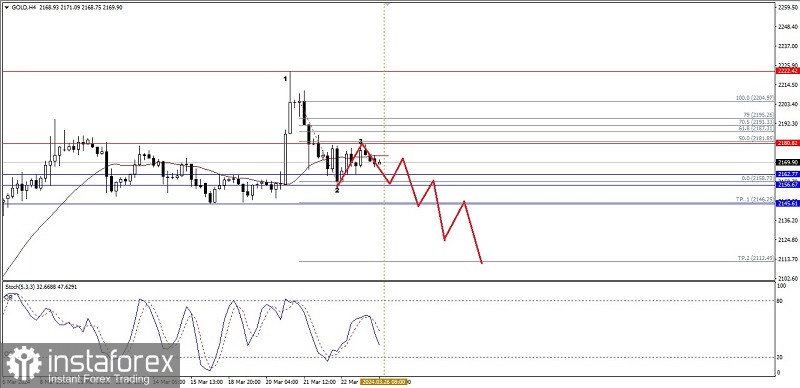

If we look on the 4 hour chart of Gold commodity asset, there is seem on the sideways condition where this is confirmed by WMA 30 Shift 2 moving between Candlestick body. Even though the existence of Gold price movement is below the WMA 30 Shift 2 and supported by Stochastic Oscillator also has intersected with SELL, then in the near future Gold has the potential to weaken down where the level of 2162,77 will try to break and if the level successfully broken down, then gold will has the potential to continue its weakness to the level 2156,67 as the main target and level 2145,61 will be the next target to be aimed of. However if on the way to those level target suddenly there is strengthening correction on the commodity asset especially if successfully broken above the level 2204,97, then the weakness scenario and downward that has been described before will automatically invalid and will cancel itself.

(Disclaimer)

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română