GBP/USD has been trading with low volatility under the recent bearish impulsive momentum. The price recently broke below 1.2500 with a daily close. The US dollar received a boost following better-than-expected US nonfarm payrolls. Since Friday, the market sentiment has been in favor of USD.

The UK is due to post a GDP report today and the market has optimistic expectations of the British economic performance in May. GBP is expected to regain certain momentum over USD which may trigger a counter-move. According to the latest surveys, British companies are more worried about Brexit than at any time since the 2016 referendum decision to leave the European Union. UK companies are planning to reduce investment and hiring. Britain's economy has slowed sharply after a strong start to 2019 when companies were rushing to prepare for the original Brexit date in March which was delayed until October 31. Recently, Bank of England Governor Mark Carney warned of the growing risks from a no-deal Brexit and from escalating trade tensions in the world economy.

British Retail Sales fell 1.6% from a year earlier in June. It added that average sales over the last 12 months edged down 0.1% which is considered to be the worst performance since 2012. The numbers follow a string of exceptionally weak purchasing managers index reports last week, which reflected both a general drop in investment due to Brexit-related uncertainties and accumulation of emergency reserves after the extension of the March 29 Brexit deadline.

Today UK GDP report is going to be published which is expected to rebound to 0.3% from the previous value of -0.4% and Manufacturing Production is expected to expand to 2.2% from the previous negative value of -3.9%. Moreover, Construction Output is expected to increase to 0.4% from the previous value of -0.4% and Industrial Production is also expected to surge to 1.6% from the previous value of -2.7%.

On the USD side, the Federal Reserve has been under pressure to cut rates recently. Nevertheless, upbeat nonfarm payrolls for June made the central bank hesitate about deep rate cuts. Citing Fed's Chairman Jerome Powell, the US economy has not changed much in the recent months. But Trump's statements spooked financial markets and the threats to the global economy became so palpable that an interest rate cut of at least 25 basis points has been priced in for the Fed's policy meeting on July 30-31. Though US economic growth remains largely on track and the jobs report for June showed robust employment, the events of May changed US trade policy from something of a sideshow in the Fed's view to a central concern. After Powell's testimony today, USD could trade with higher volatility. Powell's speech before Congress will help markets to shape sentiment on USD.

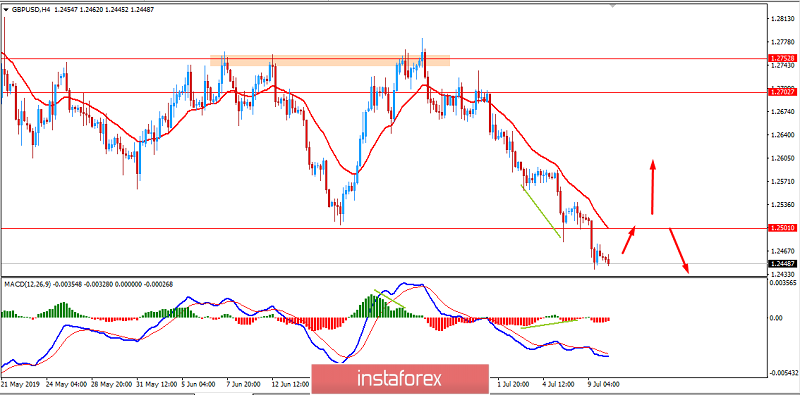

Now let us look at the technical view. The price has formed Bullish Divergence while heading below 1.2500 that indicates upward pressure in progress. Such a price move might result in a retracement or a daily close above 1.25. Target levels are seen at 1.2850 and later at 1.30. Though the preceding bearish trend is quite strong currently, a break above 1.25 may discourage sellers and invite buyers.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română