Gold sustained the bullish bias above $1,400 trading with higher volatility. The price has made some corrections since the price rebounded from $1,440 earlier. The price made some correctional declines. As the price settles firmly above $1,400 being held by the dynamic level as support, further upward pressure is still expected.

Gold price sank recently following an earlier climb amid apparent disappointment about the European Central Bank's policy update. The ECB decided on extra stimulus measures till 2020, so that disappointment hit gold hard. The price touched an intraday peak at $1,434 an ounce. Investors digested comments from ECB President Mario Draghi. The US released slightly better-than-expected economic data which may downgrade the case for aggressive action by the Federal Reserve at the policy meeting next week.

On the USD side, new orders for Durable Goods spiked much stronger in June than the forecast. Core capital goods orders also beat the forecast, suggesting that business spending on equipment picked up after it had contracted in the January to March quarter for the first time in three years. Amid such economic data, USD regained momentum but still indecisive as the probable rate cut is knocking at the door which might divert the market sentiment away from USD. Central banks worldwide have been sending dovish signals to combat concerns of a global slowdown as ongoing trade conflicts pose the risk of denting the world economy. Such economic turbulence is sertainly supportive for the gold's value.

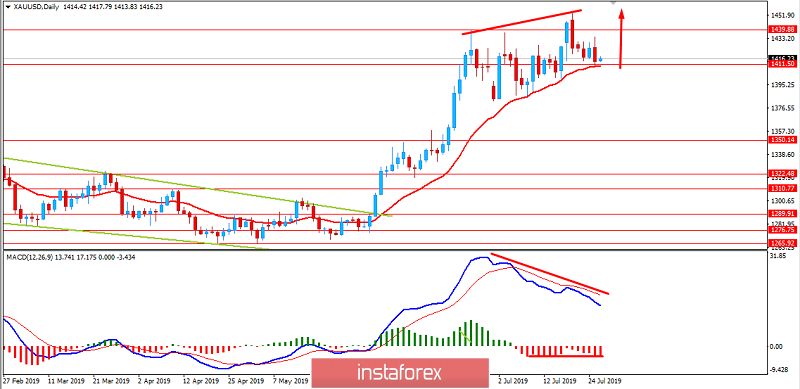

TECHNICAL OVERVIEW:

The price is currently trading at near $1,410 being held by the dynamic level as support above $1,400. This indicates that the bullish pressure is still going on that might push the price towards $1,450 and later towards $1,500 psychological area in the coming days. Certain Bearish Divergence in the MACD Moving Averages is observed but no sign of Divergence in Histogram is seen that indicates neutral position. As the price is carried higher by the 20 EMA, the door is open for the gold's price to jump as high as $1,440 and later towards $1,500 in the future.

TECHNICAL LEVELS:

SUPPORT - 1,350, 1,380, 1,400, 1,410

RESISTANCE - 1,440, 1,450, 1,500

BIAS - Bullish

MOMENTUM - Volatile

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română