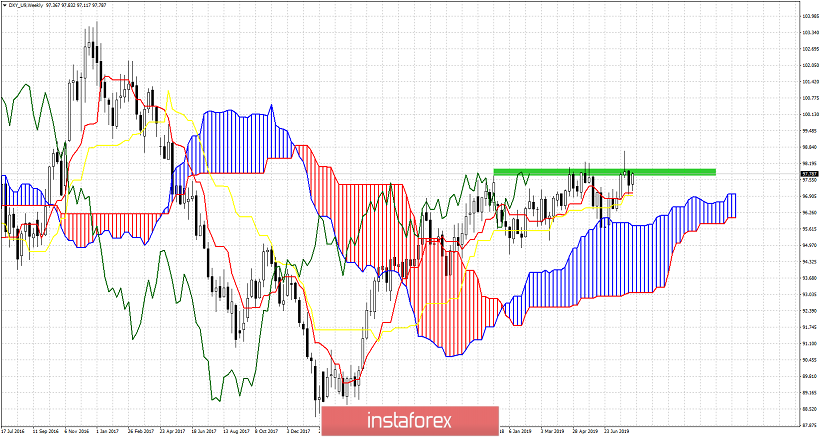

The Dollar index is making higher highs and higher lows on a monthly basis. Price has retraced 61.8% of the 103.77 to 88.22 decline. Bulls have made several attempts to break and capture the 98 level but each time price has reversed.

Green rectangle - resistance area

The weekly chart above with the Ichimoku indicator tells us that same thing. Although price has managed to move briefly above 98, the weekly result was to get rejected. In Ichimoku cloud terms price is in a bullish trend as price is above the Kumo. Price is also above both the tenkan and the kijun -sen indicators. These indicators are now at 97 which is key support. Breaking below 97 could lead to a test of the upper cloud boundary at 95.70-96. For now trend remains bullish with no sign of reversal. Another rejection and reversal from the 97.70-98 area would be a bearish sign.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română