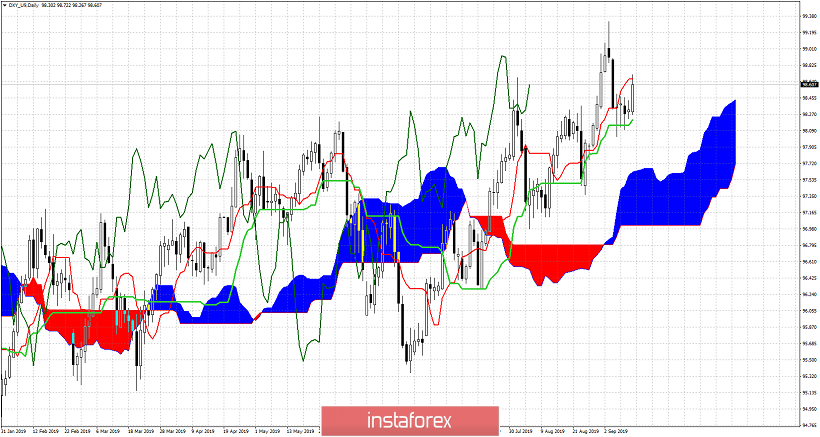

The Dollar index has back tested the very important area of 98 where it was once resistance but now support. Price remains inside a medium-term bullish channel and as long as price is above 98, we should expect a new higher high towards 100.

Red rectangle - support

Green rectangle - resistance

The Dollar index is bouncing off the support area of 97.80-98. This was once resistance and now support. Price has respected this support at the current pull back and is now bouncing. This is a sign of strength. This increases the chances of price touching and testing the green trend line resistance again.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română