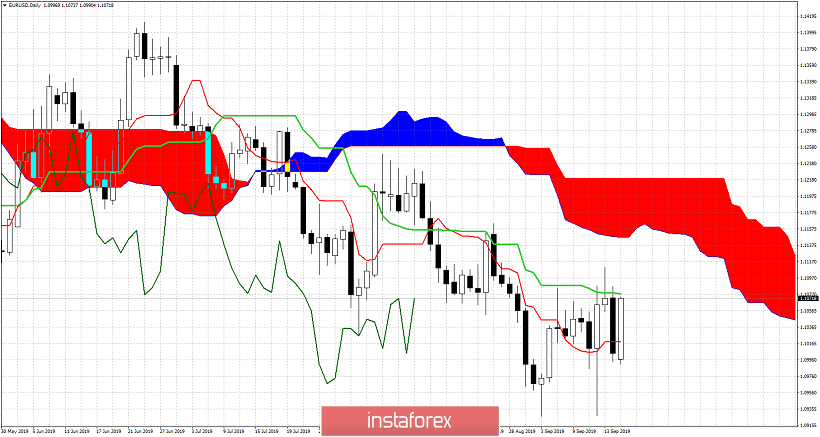

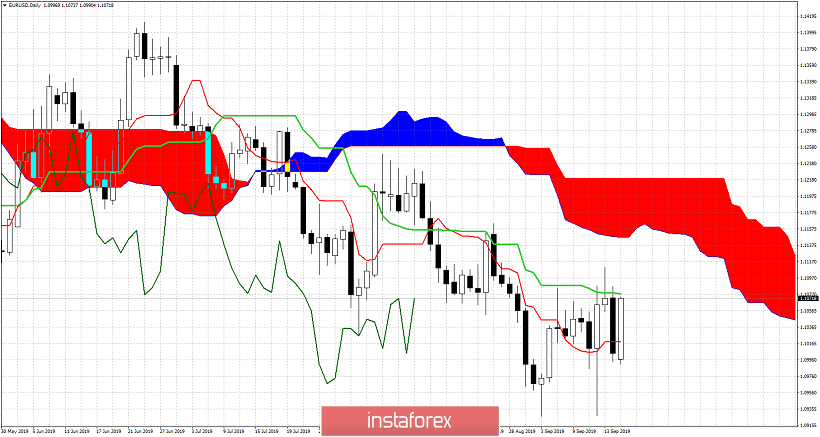

EURUSD has stopped the decline at the 61.8% Fibonacci retracement of the last leg up and is challenging important short-term resistance at 1.1080. Medium-term trend is still bearish as price is below the Kumo (cloud) but there are a lot of chances that we see 1.1130-1.1150 soon.

Price is below the Kumo but above the tenkan-sen. Price is challenging the kijun-sen at 1.1080 and if we see a break out, we should expect price to challenge the lower Kumo (cloud) boundary at 1.1130-1.1150 area. The Chikou span has a positive slope and resistance is found at 1.1145. The double bottom we noted last week at 1.0925 still holds and remains an important bullish sign, increasing the chances of more upside as long 1.10 is not broken downwards.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română