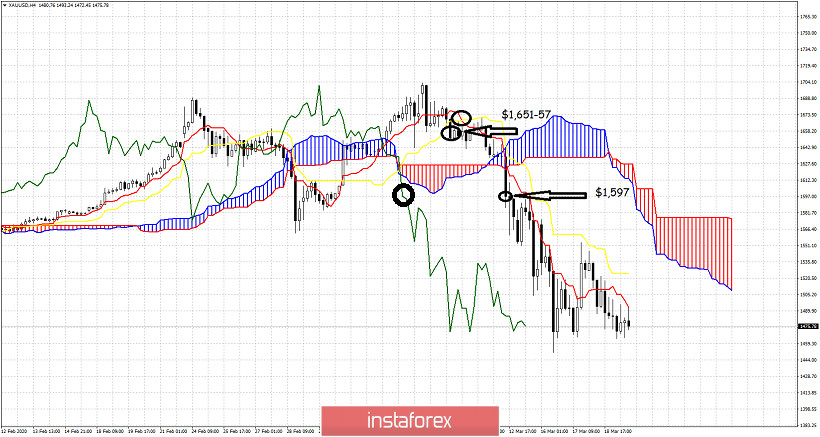

What signals has the Ichimoku cloud indicator given this far in Gold? We observe the 4 hour chart in Gold and point out the signals given during the last few days and how the COVID-19 crisis has pushed volatility off the roof for Gold prices as well.

The first bearish signal in the 4 hour chart in Gold was given when price broke down below both the tenkan-sen (red line indicator) and the kijun-sen (yellow line indicator) at $1,651. The next bearish signal was given at $1,657 when the tenkan-sen crossed below the kijun-sen. The confirmation of these bearish signals and the strongest bearish signal was given when the 4 hour candlestick closed below the Kumo and at the same time the Chikou span (green line indicator) was below the cloud. This signal was given at $1,597. Since then price continues to make lower lows and lower highs. Support is at $1,464 and a 4 hour close below that level will open the way for a move towards $1,430-$1,400. Resistance is at $1,525 and next at $1,570.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română