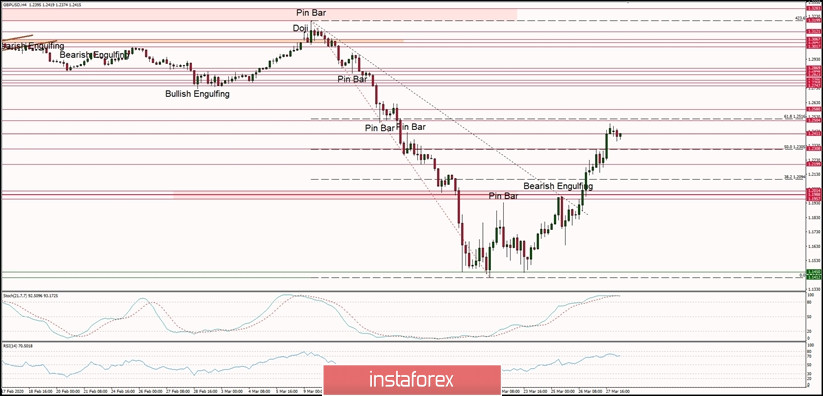

Technical Market Outlook:

The GBP/USD pair has been consequently moving higher and all the short-term technical resistance levels had been broken. The bulls have managed to almost hit the 61% of the Fibonacci retracement located at the level of 1.2516 despite the overbought market conditions. Currently, there is still no indication of a local up trend reversal and the momentum is still strong and positive. The nearest technical support is seen at the level of 1.2308 and 1.2199. Please notice, that the larger time frame trend remains down and all the moves up will be treated as a local counter-trend corrections during the down trend.

Weekly Pivot Points:

WR3 - 1.3952

WR2 - 1.3223

WR1 - 1.2933

Weekly Pivot - 1.2180

WS1 - 1.1877

WS2 - 1.1101

WS3 - 1.0804

Trading Recommendations:

The fear of the coronavirus consequences is very strong among the global investors and it rules on the financial markets. On the GBP/USD pair the main trend is down, but the reversal is possible when the coronavirus pandemic will be tamed. The key long-term technical support has been recently violated (1.1983) and the new one is seen at the level of 1.1404. The key long-term technical resistance is seen at the level of 1.3518. Only if one of this levels is clearly violated, the main trend might reverse (1.3518) or accelerate (1.1404).

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română