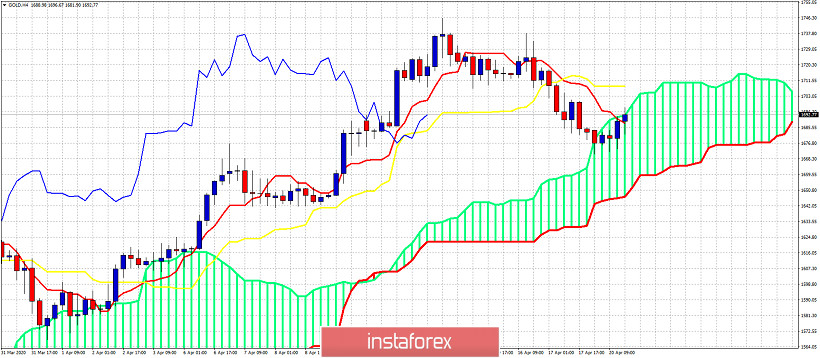

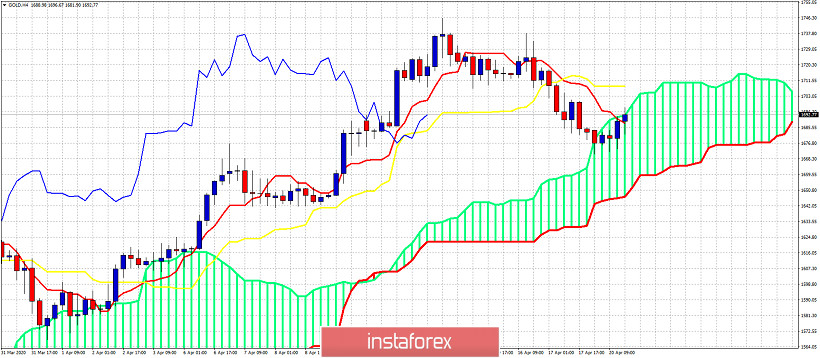

Gold price has reached our short-term target at the 4 hour Kumo and is now bouncing. So far bulls respect short-term cloud support and at the same time confirm the importance of the support area at $1,670.

Gold price has briefly entered the cloud and as we warned bulls, price pulled back from $1,740 to below $1,700. The first important support area at $1,670 has now been tested and so far bulls stepped in right on time. Bulls now want to see price breaking above the Kumo again and especially to break above the kijun-sen (yellow line indicator) at $1,710. Recapturing $1,710 is key for short-term trend. A rejection at $1,700-$1,710 could bring Gold price to a new lower low towards $1.660 or even lower.

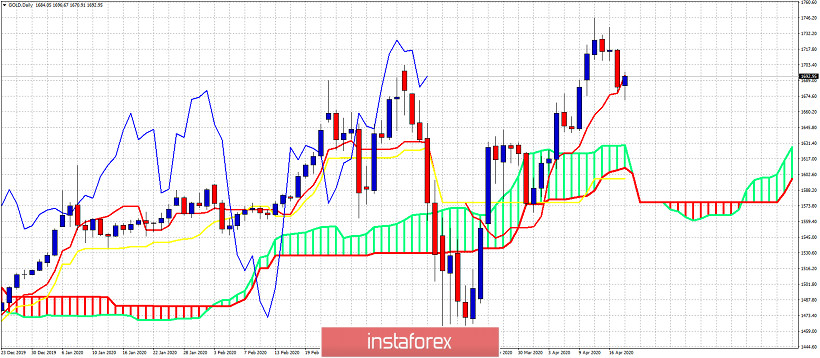

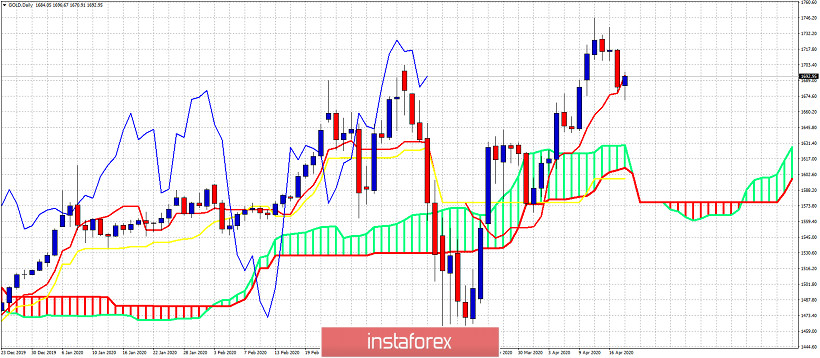

In the Daily chart Gold price is challenging the tenkan-sen (red line indicator). If we see a daily close below $1,695 then price will remain vulnerable to a move lower towards $1,630-$1,600. So far bulls have managed to hold above the tenkan-sen. A brief move below it can be sustained if price mostly moves sideways. If price closes below $1,677 we should expect more downside to come soon.

In conclusion we remain skeptic of the sustainability of the bullish trend in Gold .So far we have several warning signs and now that price has fallen below $1,700 we start to turn neutral once again. We cannot say for sure that a major top is in as price continues to make higher highs and higher lows. However it is safer to protect gains.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română