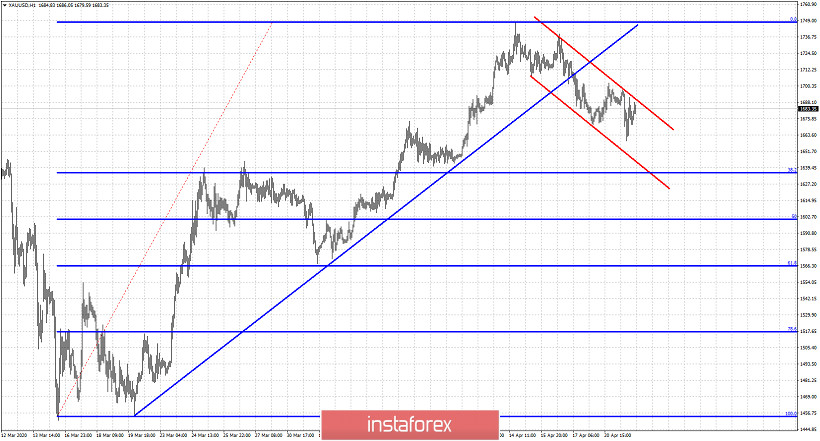

Gold price has broken out and below of the short-term bullish channel and is now trading below $1,700. Price is making lower lows and lower highs and we have now a formed bearish short-term channel.

Blue line- support trend line

The support trend line has been broken. Gold is inside the red channel and is heading towards the 38% Fibonacci retracement around $1,635 where we find the first very important Fibonacci retracement level. Breaking below it will open the way for a move towards $1.565. In previous analysis we noted several times that although Gold price was still in a bullish Daily trend, there were several warning signals that a top is imminent and that price could pull back. Price is more than $50 below 2020 highs and if this downward move continues, we should expect the March lows to be tested. Breaking below the March lows will be a huge hit to bulls as this could bring more selling pressure to Gold. Until then we focus on two major support levels, $1,635 and $1,565.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română