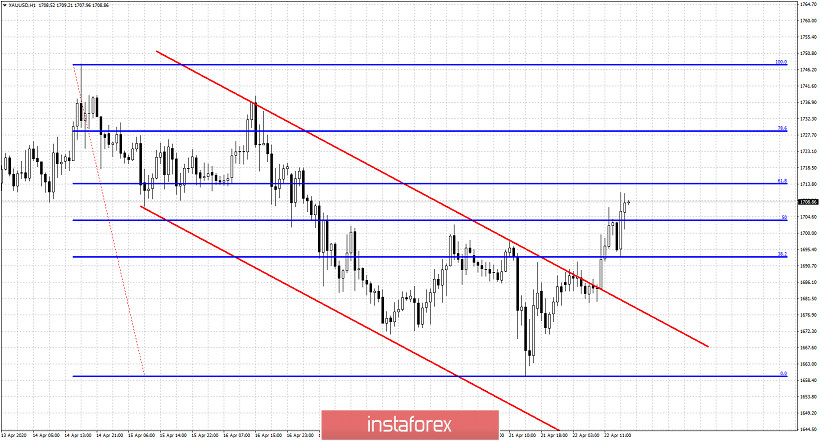

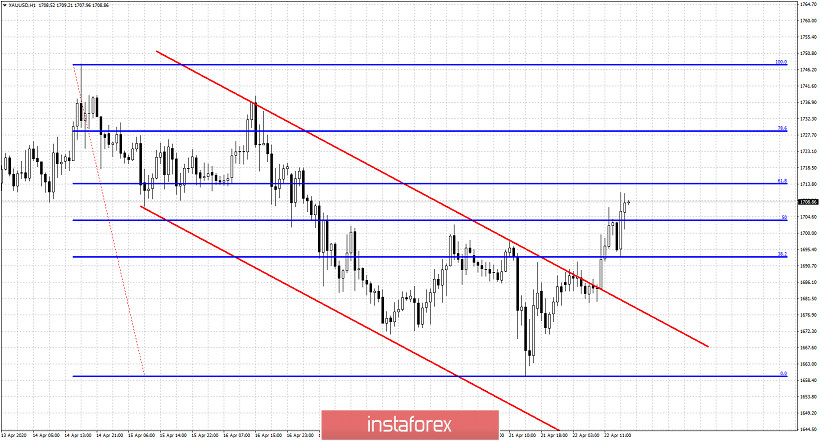

Gold price has broken above the short-term bearish channel. This is a good sign. However Gold price is now challenging important Fibonacci resistance and cloud resistance. If Gold price turns lower from current levels, then the chances of breaking below $1,675 will increase dramatically.

Red lines - bearish channel

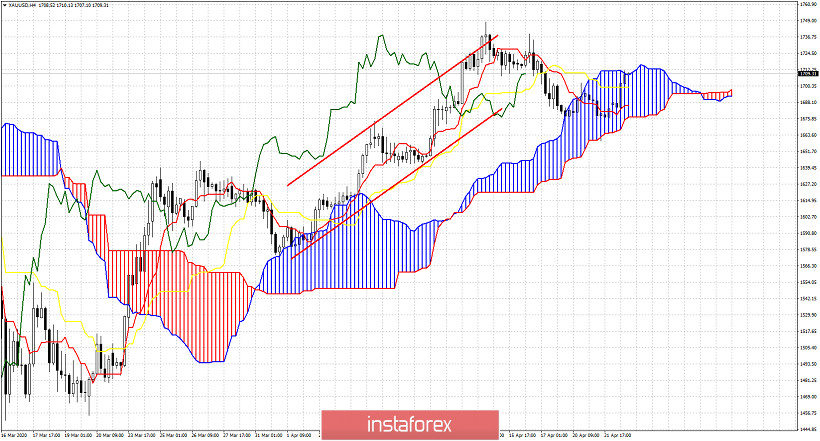

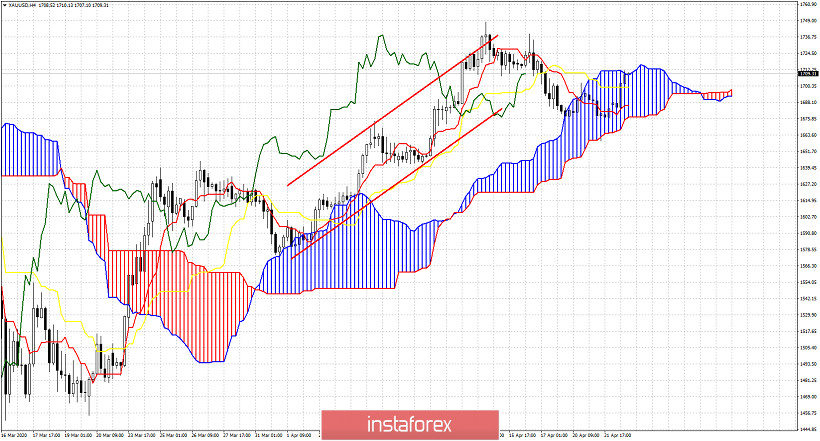

Gold price is trading above $1,700 again and it is now challenging the 61.8% Fibonacci retracement of the decline from the 2020 highs. Breaking above $1,715 will open the way for a move towards recent highs and why not break them. This break out above the 61.8% Fibo will coincide with the break out of the 4 hour Kumo.

Price is challenging the Kumo's upper boundary resistance. A rejection here will be a bearish sign. Support is found at $1,700 and $1,684, A 4 hour close below any of these two levels will bring in more sellers. Something like that will increase the chances of breaking below $1,676 and push price towards $1,630.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română