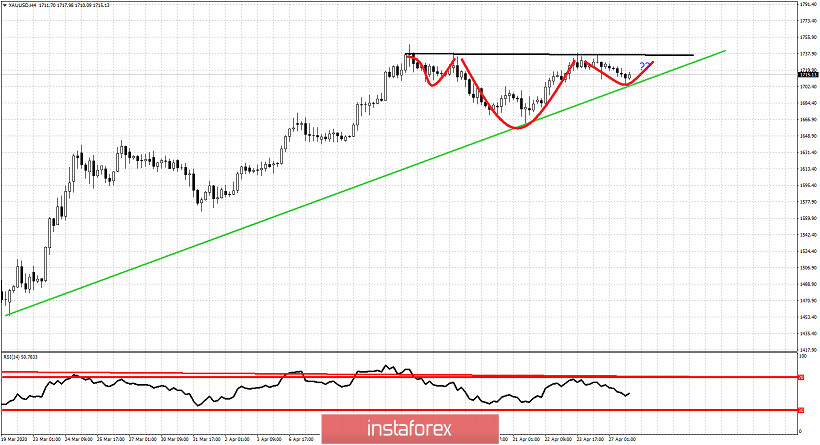

As we explained in previous posts, I expect Gold price to make a considerable reversal soon. Recent price action suggests that price could turn back below $1,700 again soon, but we also need to take under consideration the bullish Head and Shoulders pattern that has been formed.

Black line - neckline resistance

Green line - long-term support trend line

Red lines - Head and Shoulders pattern

Gold price as can be seen in the chart above, has most probably formed a H&S pattern. Breaking above $1,737 should open the way for a move to new 2020 highs towards $1,790-$1,800. Support by the upward sloping trend line is important for the medium-term trend. Breaking below $1,700 would open the way for a deeper correction.

Green line -support trend line

So far trend remains bullish. I have chosen to turn neutral or bearish as I believe the upside in Gold price is limited. The RSI is diverging and once the support trend line is broken we should see a strong move lower.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română