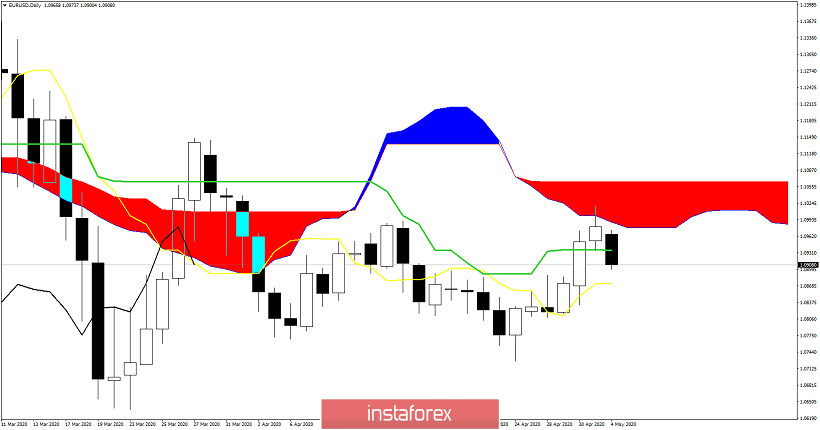

EURUSD is getting rejected at the short-term cloud resistance area. Price reached our cloud target area and is now turning back. Price shows rejection signs and if we see more weakness below 1.09, we should consider this upward move as a counter trend bounce and we should expect price to continue lower below 1.07 over the coming weeks.

EURUSD had broken an inverted head and shoulders pattern to the upside. The neckline that was once resistance is now support. Price is now back testing the break out area. If price falls below the support area then I will take it as a bearish sign. If support area holds and price bounces, I will be expecting a move above 1.1030 over the coming sessions.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română