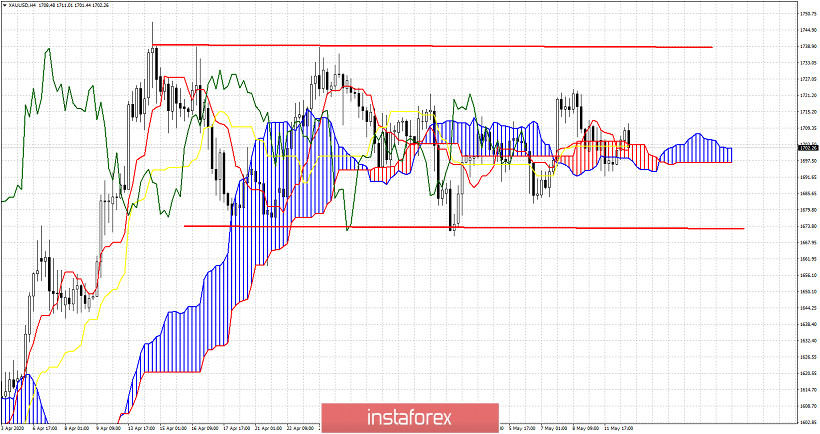

Gold price remains inside the trading range of $1,740-$1,670. Price is moving above and below the Ichimoku cloud in the 4 hour chart. In such sideways movements we prefer to focus on the Daily chart. In the 4 hour chart as shown below price has managed to push back above the cloud again. However this is no clear signal unless price breaks above recent high at $1,723.

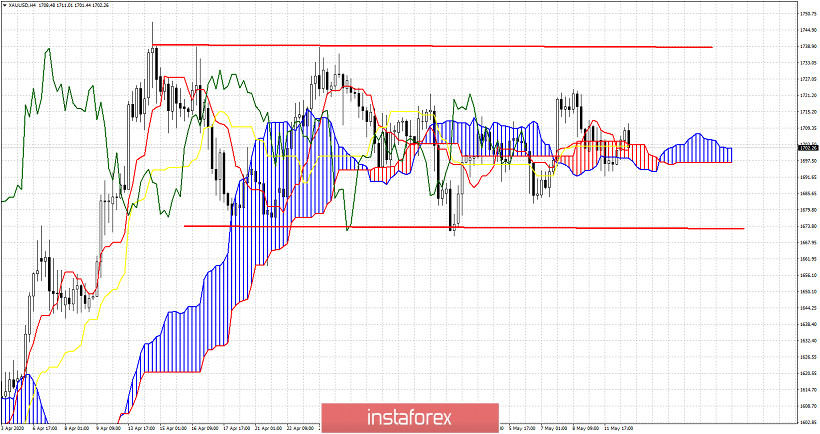

In the Daily chart we focus on the kijun-sen which is rising as the major pivot point for the trend and any signal we might get.

Trend remains bullish. The kijun-sen is at $1,678, very close to the lower trading range boundary. Breaking below it will open the way for a move towards $1,630 and the Kumo (cloud). Resistance is at $1,720-25 area. Breaking above it will open the way for new 2020 highs. Although in previous posts we noted that we prefer to be neutral or bearish Gold around $1,740, at this point if we see a move above $1,725 it could be a nice bullish short-term opportunity. But only for the very short-term. Weekly bearish divergence is a big warning sign not to be forgotten.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română