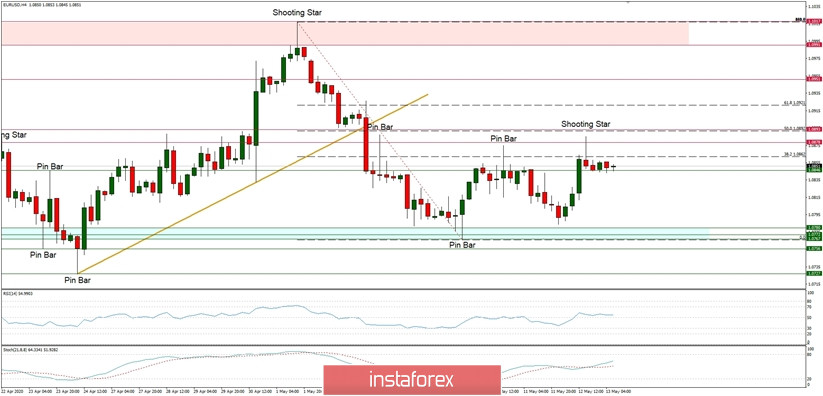

Technical Market Outlook:

The EUR/USD was rejected for the second time at the level of 38% Fibonacci located at 1.0862 after a Shooting Star candlestick pattern was mad around the level of 1.0878. The bears are pushing the price towards the level of 1.0767 again. The bulls hasn't made a new local high yet, so the next target for them is still seen at the level of 38% Fibonacci retracement at 1.0862 and 1.0878. This level must be clearly violated in order to rally towards higher levels. The momentum remains neutral, but might turn negative any time now.

Weekly Pivot Points:

WR3 - 1.1136

WR2 - 1.1058

WR1 - 1.0936

Weekly Pivot - 1.0853

WS1 - 1.0718

WS2 - 1.0627

WS3 - 1.0520

Trading Recommendations:

The fear of the coronavirus consequences has decreased among the global investors on the financial markets. On the EUR/USD pair the main long term trend is down, but the reversal is possible when the coronavirus pandemic will be tamed. The key long-term technical support is seen at the level of 1.0336 and the key long-term technical resistance is seen at the level of 1.1540. Only if one of this levels is clearly violated, the main trend might reverse (1.1540) or accelerate (1.0336).

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română