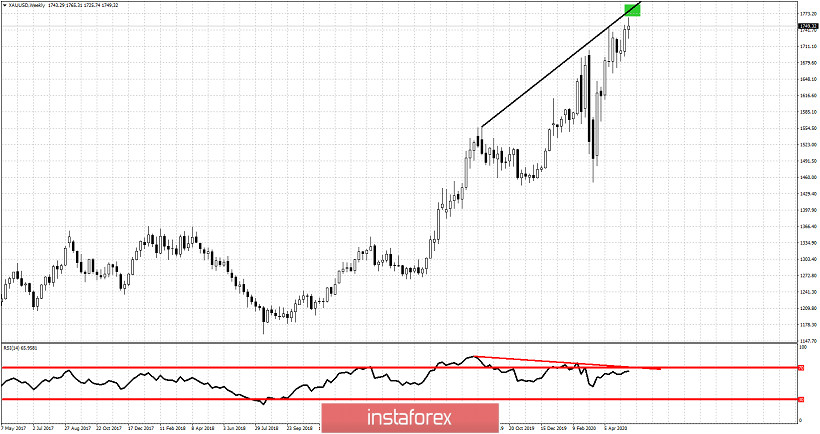

Gold price remains in a bullish trend. Price continues to respect and trade above short-term support Ichimoku indicators. Although technically we still observe bearish divergence signals in the weekly chart, there is no reversal signal yet.

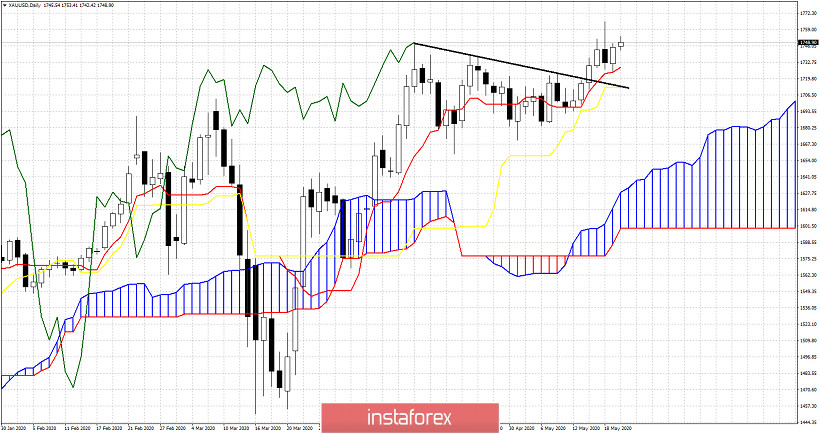

Gold price after breaking above the black resistance trend line has provided a new 2020 high and continues to hold above the tenkan-sen and kijun-sen indicators. Support by those two indicators has now risen towards $1,728 and $1,712 respectively. As long as price is above these two levels short-term trend remains bullish targeting $1,770-80 as we explained in previous posts.

Red line -bearish divergence

Green rectangle -target

Gold price is diverging on a weekly basis. This is an important warning not to get too optimistic at $1,750 and above. Yes price could reach $1,780 but the downside potential is bigger. Key reversal level is the $1,700 base and the $1,710-20 support area. Looking closely for any clues of a reversal. So far no sign. Bulls need to be cautious.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română